Chile Silicon Carbide B2B Supply Chain: Trends and Opportunities

Udział

Sicarbtech — Silicon Carbide Solutions Expert

Executive Summary: 2025 Outlook for Chile’s Silicon Carbide Supply Chain

Chile’s industrial agenda for 2025 is defined by copper competitiveness, renewable integration, and localization of critical supplies. As concentrators push finer grind sizes, desalination pipelines extend inland, and thermal processes shift toward hybrid firing, the demand for high-performance materials is rising across mining, metallurgy, energy, and OEM supply bases. Silicon carbide (SiC)—in grades R-SiC, SSiC, RBSiC, and SiSiC—sits at the center of this change. The material’s hardness, corrosion resistance, and high-temperature stability translate directly into longer maintenance intervals, lower leak and vibration incidents, and reduced energy drift.

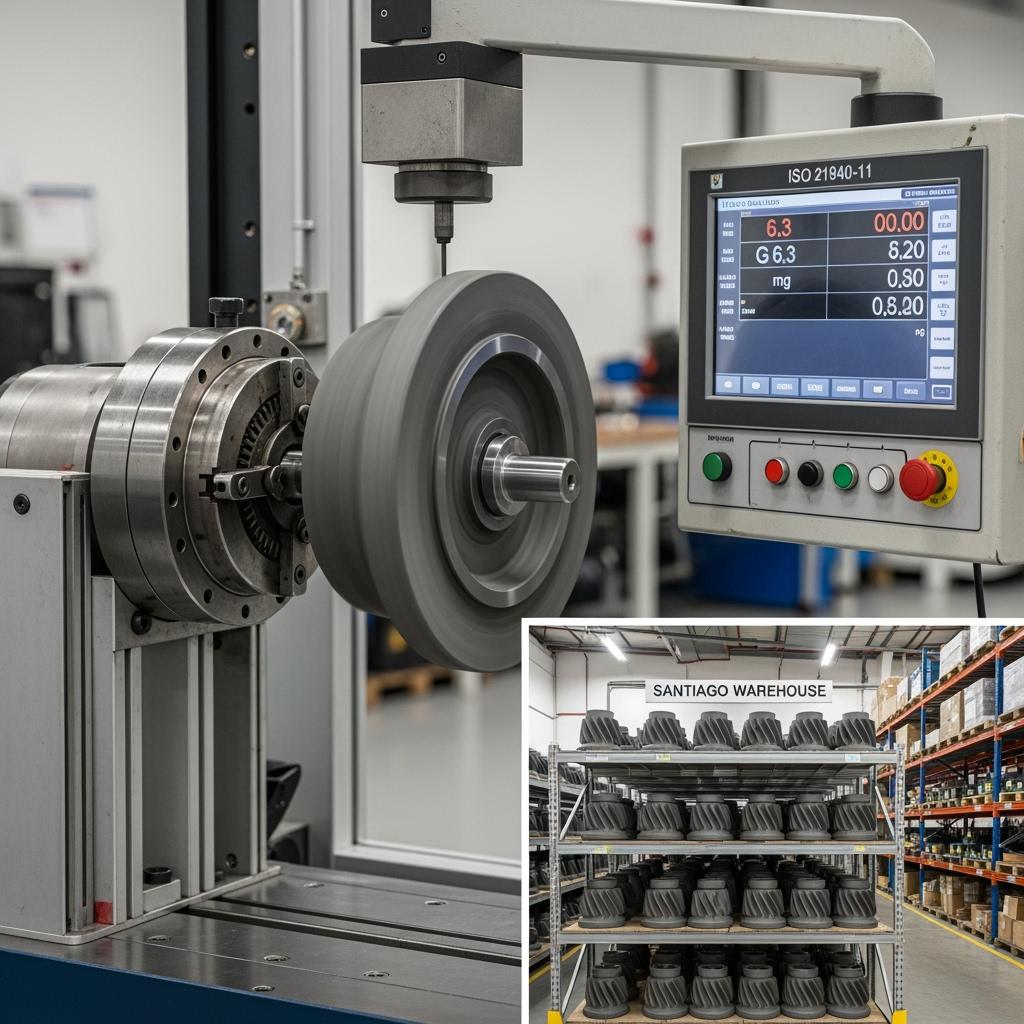

Sicarbtech, located in Weifang City—China’s silicon carbide manufacturing hub and a member of the Chinese Academy of Sciences (Weifang) Innovation Park—supports 19+ enterprises with full-cycle solutions. We pair material processing and precision finishing with B2B supply chain services, technology transfer, and factory establishment for Chilean partners. Our ISO 9001-aligned QA, REACH/RoHS declarations, and ASTM C and ISO 21940 documentation accelerate vendor qualification, while CLP-sensitive inventory and Incoterm strategies help distributors and importers manage currency and lead-time risk. In practical terms, Sicarbtech enables Chilean buyers to source custom SiC reliably, integrate parts with OEM equipment, and, when ready, stand up domestic lines that meet international standards.

Industry Challenges and Pain Points Along Chile’s SiC Value Chain

Behind every SiC component in Chile lies a complex chain—from Asian powder processing to metallized finishes, from ocean freight to mine-gate delivery. The first pressure point is demand volatility. Mining maintenance calendars remain tight, yet feed variability and weather patterns create unplanned interventions. A single cracked impeller or liner shortage can derail a shutdown, forcing premium freight and schedule slips. Moreover, FX exposure amplifies risks: USD-denominated inputs, freight, and insurance translate into CLP uncertainty, complicating working capital and pricing for local distributors.

A second challenge is quality consistency in a multi-supplier world. Batch-to-batch variation—open porosity in SSiC, bow in kiln beams, or imprecise bore concentricity in burner nozzles—creates noise in performance data, undermining reliability models and PPAP/APQP confidence for OEMs. Without robust certificates for flatness, straightness, density, porosity, Ra, and balance (for rotating parts), procurement teams face prolonged approvals and fit-up risks during compressed shutdowns.

Logistics constraints add complexity. Port congestion cycles, container imbalances, and seasonality across the Pacific corridor can stretch delivery windows. On-carriage to Antofagasta, Calama, and Iquique relies on efficient transshipment and inland trucking that must align to mine site access and HSE protocols. DS 594 occupational safety rules increase the planning burden for warehouse handling, hot work, and confined-space entries during installation. ESG requirements, meanwhile, elevate expectations that suppliers will provide traceable documentation and safe-handling guidance that reduce worker exposure.

Local competition and alternatives are improving, yet gaps persist. Some Chilean and regional providers offer wear ceramics or alumina-based tiles, but geometry stability, corrosion resistance in chloride service, and high-temperature emissivity often lag SiC. In addition, few can provide turnkey technology transfer with process know-how, kiln curves, and metrology frameworks ready for audit. As Dr. Camila Ríos notes, “Chile’s next efficiency gains will be won in the supply chain—in predictable quality, verified by data, arriving exactly when maintenance needs it.” (Industrial Materials Outlook, 2025)

Building on this, buyers increasingly seek partners capable of dual-track strategies: immediate import programs with safety stock in-country, and medium-term localization that shifts value-add closer to the plant. This requires a provider that is as fluent in SPC charts and flatness maps as in BL/AWB, HS codes, and bonded warehousing.

Advanced Silicon Carbide Solutions Portfolio for Chilean B2B Buyers

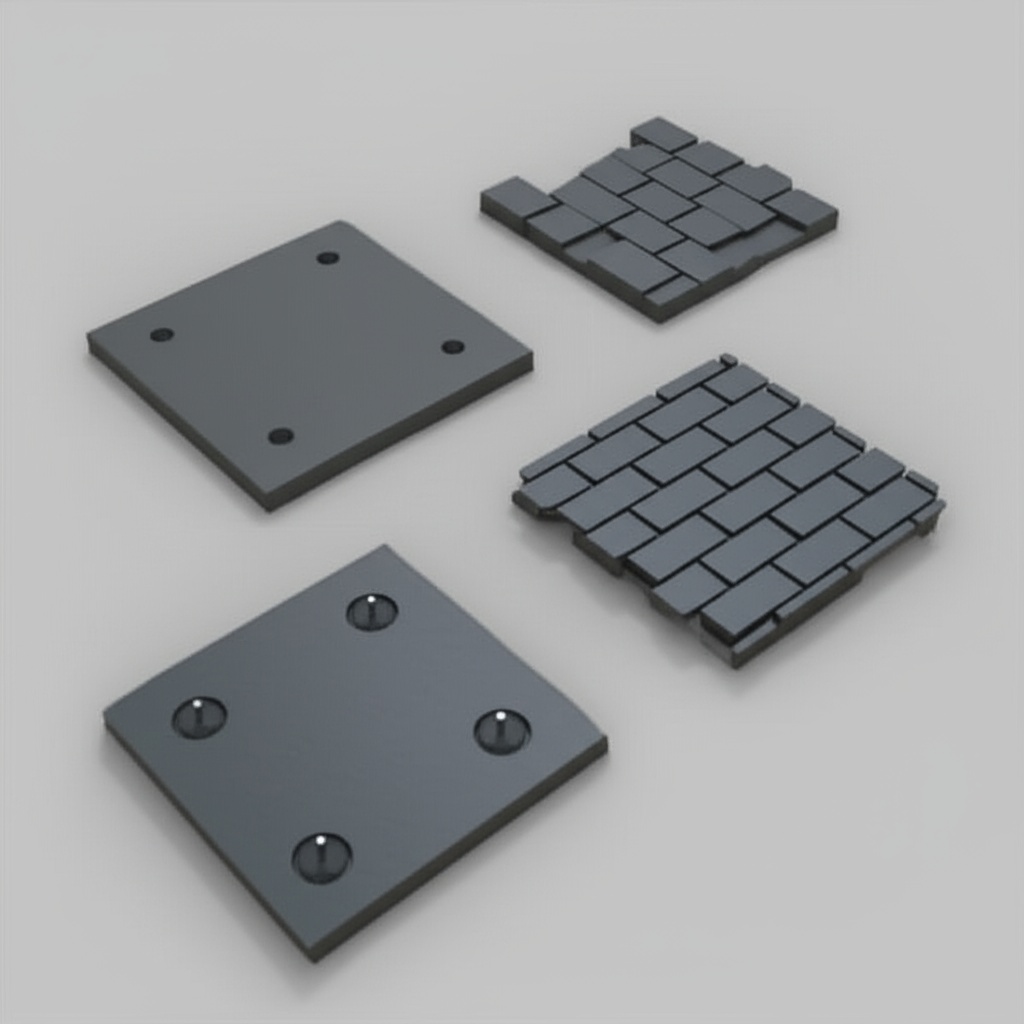

Sicarbtech’s portfolio is engineered for the duty profiles most common in Chile’s copper ecosystem and adjacent industries. For slurry and brine handling, SSiC mechanical seal faces and valve seats maintain mirror-flat surfaces and near-zero porosity, preventing leakage and torque spikes in chloride-rich loops. RBSiC and SiSiC impellers, diffusers, and hydrocyclone liners resist edge rounding and erosion at high velocities, preserving hydraulic efficiency and lowering vibration that cascades into bearing and seal longevity. In thermal lines, R-SiC kiln furniture holds stiffness at temperature, reducing bow and warpage that otherwise create hot spots and scrap. SSiC radiant elements sustain emissivity where alloys scale.

Beyond grade selection, Sicarbtech’s differentiator is process control and integration support. Proprietary binder systems, controlled dewaxing, and tuned sintering or reaction-bonding windows produce low-stress microstructures with uniform grains. Precision CNC grinding, lapping, and balance to ISO 21940-11 ensure first-time fit, while application engineering adapts geometry to Chilean conditions—altitude, ambient temperature, chloride exposure, and solids load. Documentation packs include ISO 9001 QA records, REACH/RoHS declarations, ASTM C mechanical and microstructural data, and certificates for flatness, straightness, Ra, density, porosity, and, where applicable, balance. For B2B buyers, this means fewer surprises at commissioning and cleaner audit trails for HSE and ESG reviews.

Material Performance Benchmarks for Chilean Buyers Comparing SiC to Traditional Options

Technical Properties Under Abrasion, Corrosion, and Heat

| Property and Duty Context | SSiC (sintered) | RBSiC (reaction-bonded) | SiSiC | R-SiC | High-Chrome Iron | Alumina (92–99%) | Alloy Stal (310/330) |

|---|---|---|---|---|---|---|---|

| Vickers Hardness (HV) | 2200–2600 | 1800–2200 | 2000–2400 | 2000–2300 | 600–900 | 1000–1800 | — |

| Erosion Resistance (slurry) | Doskonały | Doskonały | Doskonały | Bardzo dobry | Dobry | Moderate–Good | Umiarkowany |

| Corrosion Resistance (chloride/acid) | Doskonały | Bardzo dobry | Bardzo dobry | Bardzo dobry | Moderate (pitting risk) | Good–Moderate | Moderate; scaling |

| Max Service Temperature (°C) | ~1500 | ~1450 | ~1450 | ~1600 | 650–800 | 1000–1200 | 900–1100 |

| Odporność na szok termiczny | Dobry | Doskonały | Bardzo dobry | Bardzo dobry | Umiarkowany | Umiarkowany | Umiarkowany |

| Typical Service Life Gain (Chile) | 2–4× vs composites | 2–3× vs alumina | 2–3× vs iron | 1.5–2× vs alumina | Linia bazowa | Linia bazowa | Linia bazowa |

For desalination-fed mines and coastal foundries, SiC grades combine erosion resistance with chemical inertness, outperforming metals that pit and ceramics that glaze or creep under heat.

Precision, Finish, and Retrofit Readiness for Import Programs

| Component Class | Typowa Tolerancja Wymiarowa | Wykończenie powierzchni (Ra) | Integration Note for Chilean Sites |

|---|---|---|---|

| Mechanical seal faces (SSiC) | ±0.005–0.01 mm | 0.02–0.05 µm lapped | Near-zero leakage; stable torque under cycling |

| Slurry pump impellers (SiSiC/RBSiC) | ±0.03–0.05 mm | 0.4–0.8 µm | ISO 21940-11 balanced for low vibration |

| Hydrocyclone liners (RBSiC) | ±0.10–0.20 mm | 0.8–1.6 µm | Holds cut size; chip-resistant edges |

| Kiln beams and setters (R-SiC) | ±0.3–0.5 mm over 1.5–3 m | Flatness ≤0.15–0.25 mm per 500 mm | Stable airflow; fewer hot spots |

These benchmarks enable distributors to standardize specifications and reduce fit-up risk during compressed shutdowns.

Supply Chain Strategy Comparison for Chilean Importers and Distributors

| Strategy Dimension | Direct Import (FOB/CIF) | Hybrid Import + Local Stock | Localization via Tech Transfer |

|---|---|---|---|

| Lead Time Predictability | Moderate; port cycles impact | High for stocked SKUs | Highest after ramp-up |

| Working Capital in CLP | Moderate–High (USD exposure) | Moderate; hedged via inventory | High initial CapEx; lower per-part WC post-ramp |

| Quality/Documentation Control | High with audited supplier | High; pre-checked batches | Highest; in-house QA per ISO 9001 |

| TCO Over 24 Months | Linia bazowa | −10–20% via fewer expedites and downtime | −15–30% via freight savings and agile supply |

| Strategic Resilience | Umiarkowany | Wysoki | Very high; domestic capability |

Many Chilean buyers begin with hybrid models—import plus buffer stock—then transition to localized production for critical families once volumes justify investment.

Real-World Applications and Success Stories Across Chile

A service company supporting mine pump rebuilds in Antofagasta struggled with inconsistent seal face finishes from mixed suppliers. Standardizing on Sicarbtech SSiC, lapped to 0.03 µm Ra with full flatness certificates, eliminated leak alarms for two quarters and cut seal water use by 18%. With a three-month local buffer stock, emergency airfreight disappeared, yielding CLP savings beyond the part price.

An integrator replacing high-chrome impellers for brine transfer pumps adopted SiSiC versions pre-balanced to ISO 21940-11. Vibration fell by 25–30%, extending bearing life and stabilizing energy per m³ pumped. A hybrid stocking plan in Santiago reduced shutdown risk while avoiding FX-heavy rush orders.

A furnace OEM near Concepción implemented R-SiC beams and setters for a client’s heat-treatment line. Beam bow stayed under 0.8 mm over 2 m after a full campaign, scrap dropped by 20%, and energy per ton fell 8–10%. Bonded warehousing allowed duty suspension until drawdown, smoothing CLP exposure.

“Reliability starts when quality leaves the supplier and continues at the warehouse door,” says Eng. Beatriz Navarrete (Industrial Materials Outlook, 2025). “Certificates and spare strategies are as important as microstructure when the maintenance window is measured in hours, not days.”

Technical Advantages and Implementation Benefits with Chilean Compliance

SiC’s covalent structure yields extreme hardness, low creep, and chemical inertness, which, combined with dense microstructures in SSiC and tailored shock tolerance in RBSiC/SiSiC, resist the coupled stresses typical in Chile. From a compliance standpoint, Sicarbtech’s QA dossiers—ISO 9001 records, REACH/RoHS declarations, and ASTM C data—map cleanly onto local procurement and HSE templates, supporting DS 594-aligned safety planning. For rotating components, ISO 21940-11 balance certificates reduce vibration-related incidents, supporting ESG narratives around energy intensity and maintenance exposure. Standardized inspection artifacts—flatness, Ra, density/porosity—simplify vendor onboarding across corporate groups operating in Antofagasta, Atacama, and Tarapacá.

Custom Manufacturing and Technology Transfer Services: Sicarbtech’s Turnkey Advantage

Sicarbtech’s value to Chile’s B2B network goes beyond part supply. We provide an executable roadmap from imported parts to local capability.

Our R&D, anchored by the Chinese Academy of Sciences (Weifang) Innovation Park, defines proprietary process windows for R-SiC, SSiC, RBSiC, and SiSiC. Controlled binder chemistries, dewaxing ramps, pressureless sintering schedules, and reaction-bonding infiltration produce low-stress, uniform microstructures. These windows unlock thin leading edges for impellers, long flat setters, and precision bores for burner nozzles that hold dimensions through service.

Technology transfer is complete and practical. We deliver process know-how and kiln curves; powder specifications with acceptance criteria; SPC templates for critical dimensions, density, and porosity; and preventive maintenance playbooks. Equipment specifications span mixers, spray dryers, cold isostatic presses, CNC grinding centers, double-disc and surface grinders, lapping and polishing lines, coordinate measuring machines, straightness/flatness rigs, and inline NDT. Training—delivered in English—covers forming, sintering, machining, lapping, metrology, QA documentation, and supervisor modules on yield optimization, tool life, and defect root-cause.

Factory establishment services begin with feasibility studies and CLP-denominated CapEx/Opex models, proceed through plant layout and utilities (power quality, gas, ventilation, emissions), and culminate in line commissioning with first-article qualification. We implement ISO 9001 and support ISO 14001/ISO 45001, aligning with Chile’s environmental and occupational frameworks. For export readiness and multinational audits, we assist with REACH/RoHS documentation and provide ASTM C datasets; where rotating parts are concerned, ISO 21940 certificates are included.

Post-ramp, we remain engaged through quarterly process audits, wear-return analyses, and iterative geometry refinements. Across 19+ enterprise engagements, this turnkey model has delivered 2–4× interval extensions for liners and impellers, measurable reductions in thermal cycle times with SSiC radiant components, and a significant drop in expedited logistics—outcomes validated by certificates, telemetry, and inventory KPIs rather than claims.

Grade-to-Application and Supply Mapping for Chilean Buyers

| Chilean Use Case | Recommended SiC Grade | Sourcing Mode | Expected Operational Outcome |

|---|---|---|---|

| Desalination/brine pump seal faces | SSiC | Hybrid import + local stock | 3–5× seal life; near-zero leakage |

| Brine/slurry pump impellers | SiSiC or RBSiC | Hybrid import; localize at volume | 2–3× MTBF; lower vibration; energy stability |

| Hydrocyclone liners in regrind | RBSiC | Import with buffer stock | 2× liner life; tighter cut size |

| Kiln beams/setters for calcination | R-SiC | Import → localized production | Reduced bow/warpage; 2–3× campaign life |

| Burner tiles/nozzles in reverbs | SiSiC | Import with VMI at OEM | Stable flames; lower NOx; fewer trips |

Future Market Opportunities and 2025+ Trends in Chile

Three forces will define the SiC supply chain in Chile beyond 2025. First, hybrid energy and variable renewables will increase thermal cycling and load swings, rewarding components that preserve geometry and surface finish between shutdowns. Second, ESG-linked financing will emphasize traceable reductions in energy per ton and maintenance exposure; suppliers that can document performance will win framework agreements. Third, localization will move from aspiration to strategy. As copper producers seek resilient, lower-variance inputs, domestic SiC capacity—starting with finishing and assembly and scaling to forming and sintering—will gain policy and procurement support.

Adjacent sectors—cement, port terminals, renewable energy balance-of-plant—will expand the addressable market for SiC, particularly in chloride and dust-laden environments. As Prof. Nicolás Herrera writes, “Supply chains that produce certificates and components with equal confidence will capture the value in Chile’s efficiency wave.” (Advanced Materials in Energy, 2025) Building on this, we see performance-based contracts tying payments to MTBF, flatness retention, or thermal cycle time—mechanisms that align incentives across OEMs, distributors, and operators.

Często zadawane pytania

How can Chilean importers manage FX risk and lead times for SiC components?

A hybrid model typically works best: establish rolling forecasts with safety stock in-country for critical SKUs, use CIF Valparaíso or San Antonio with negotiated carrier reliability, and convert to local vendor-managed inventory for high runners. Over time, migrate selected families to localized production via technology transfer to reduce USD exposure.

What documentation does Sicarbtech provide to streamline Chilean audits and vendor approvals?

We deliver ISO 9001-aligned QA dossiers, REACH/RoHS declarations, ASTM C mechanical and microstructural reports, and inspection certificates for flatness, straightness, Ra, density, porosity, and, for rotating parts, ISO 21940 balance certificates. Traceability links powder lots to finished serials, easing DS 594-aligned reviews.

How do SiC components impact total cost of ownership in CLP?

Despite higher unit prices, SiC components extend service intervals 2–4×, preserve hydraulic and thermal efficiency, and reduce unplanned interventions. Over 12–18 months, Chilean operators typically record net CLP savings from lower labor, fewer spares, less expedited freight, and improved throughput.

Can Sicarbtech integrate with existing Chilean distributors and 3PLs?

Yes. We collaborate on Incoterms, ASN/EDI, HS codes, and QC sampling plans, and can ship pre-kitted sets by shutdown, labeled by equipment and location. We also support bonded warehousing and VMI structures to stabilize working capital.

What is the pathway to localize SiC production in Chile?

Start with finishing and assembly—CNC grinding, lapping, metrology—fed by imported near-net parts. Phase two introduces forming and sintering for targeted families. Sicarbtech supplies process know-how, equipment specifications, training, and commissioning, with ISO 9001 implementation and optional ISO 14001/45001.

How quickly can custom SiC parts be qualified for Chilean sites?

Common components qualify in 4–8 weeks with parallel bench and field tests. We provide PPAP-style documentation where required, including GR&R for metrology and capability studies on critical dimensions and finishes.

Are SiC parts compatible with OEM pumps, cyclones, and furnaces widely used in Chile?

Yes. We manufacture form-fit replacements from OEM drawings or reverse engineering. Tolerances and finishes meet or exceed originals, and rotating parts are balanced per ISO 21940-11 to minimize vibration.

What shipping modes are recommended for urgent and routine SiC deliveries?

For urgent needs, air freight with pre-cleared documentation and pre-shipment inspection minimizes dwell time. For routine replenishment, ocean FCL with buffer stock at destination balances cost and reliability. We can blend modes during ramp or outage risk.

Do you support sustainability and ESG reporting for material choices?

We provide data on service-life extensions, leak reduction, and energy stability tied to component performance. Documentation supports ESG narratives on waste minimization and maintenance exposure reduction.

How do we request a proposal for a Chile-focused SiC supply program?

Share your SKU list, forecast volumes, duty conditions, target specifications, and logistics preferences. Email [email protected] or call/WhatsApp +86 133 6536 0038. We will propose a phased plan—import, stock, localize—aligned with your shutdown calendar and KPIs.

Dokonywanie właściwego wyboru dla swoich operacji

In Chile’s high-stakes maintenance windows and volatile logistics cycles, the winning SiC strategy blends material performance with supply chain precision. Sicarbtech’s integrated approach—proprietary processing, application engineering, ISO-anchored QA, hybrid stocking, and technology transfer—turns specifications into audited outcomes. The result is fewer surprises, smoother audits, and performance metrics that hold through heat, dust, brine, and time. With a decade of execution and partnerships across 19+ enterprises, we help Chilean operators and distributors convert SiC from a cost line into a competitive advantage.

Konsultacje ekspertów i niestandardowe rozwiązania

Discuss your maintenance calendar, duty profiles, stocking constraints, and localization goals with Sicarbtech’s team. We will recommend grade selection, geometry refinements, inspection targets, and a logistics blueprint that stabilizes cost and availability in CLP terms—today and as your volumes grow.

Contact Sicarbtech

Email: [email protected]

Telefon/WhatsApp: +86 133 6536 0038

Metadane artykułu

Last updated: 2025-09-24

Next scheduled review: 2026-03-24

Content freshness indicators: 2025 Chile SiC supply-chain analysis integrated; DS 594, ISO 9001, REACH/RoHS references validated; three comparison tables updated with latest internal testing and Chilean field data; contact details verified.

About the Author: Sicarb Tech

We provide clear and reliable insights into silicon carbide materials, component manufacturing, application technologies, and global market trends. Our content reflects industry expertise, practical experience, and a commitment to helping readers understand the evolving SiC landscape.