B2B Opportunities in Pakistan’s Silicon Carbide Market

Share

Sicarbtech — Silicon Carbide Solutions Expert. From Weifang City, China’s silicon carbide manufacturing hub, and as a member of the Chinese Academy of Sciences (Weifang) Innovation Park, we partner with Pakistani distributors, OEMs, and industrial end‑users to build resilient, profitable silicon carbide businesses. With more than 10 years of customization experience and collaborations with 19+ enterprises, Sicarbtech delivers full‑cycle solutions—from powder engineering and grading to advanced ceramics and shaped refractories—plus turnkey factory establishment and technology transfer for localized capability.

Executive Summary: 2025 Outlook for B2B Silicon Carbide in Pakistan

Pakistan’s industrial economy is entering a reliability decade. Energy volatility, PKR currency swings, and tightening provincial environmental oversight are pushing buyers to prioritize lifecycle value, uptime, and audit readiness. As a result, silicon carbide (SiC) is moving from occasional sourcing to strategic supply programs. Whether it is black and green SiC abrasives for foundries and roll shops, SiC‑rich refractories for cement and steel, or engineered SiC ceramics for chemical, textile, and power plants, the market is shifting toward documented quality, predictable lead times, and engineered outcomes.

Furthermore, procurement frameworks are maturing. PSQCA‑referenced conformity is appearing more frequently, ISO 9001/14001/45001 adoption is broadening, and export‑linked customers now ask for traceable material batches and third‑party test reports. Distributors and agents who can pair competitive pricing with technical credibility, application engineering, and local stocking will capture outsized share. Building on this shift, Sicarbtech offers integrated B2B models: OEM and ODM services, private labeling, distributor enablement, and technology transfer that creates local finishing and assembly capacity to reduce FX exposure and lead‑time risk. The 2025 outlook is clear—winners will blend market access with material science, documentation, and service discipline.

Industry Challenges and Pain Points in Pakistan’s SiC Supply Chain

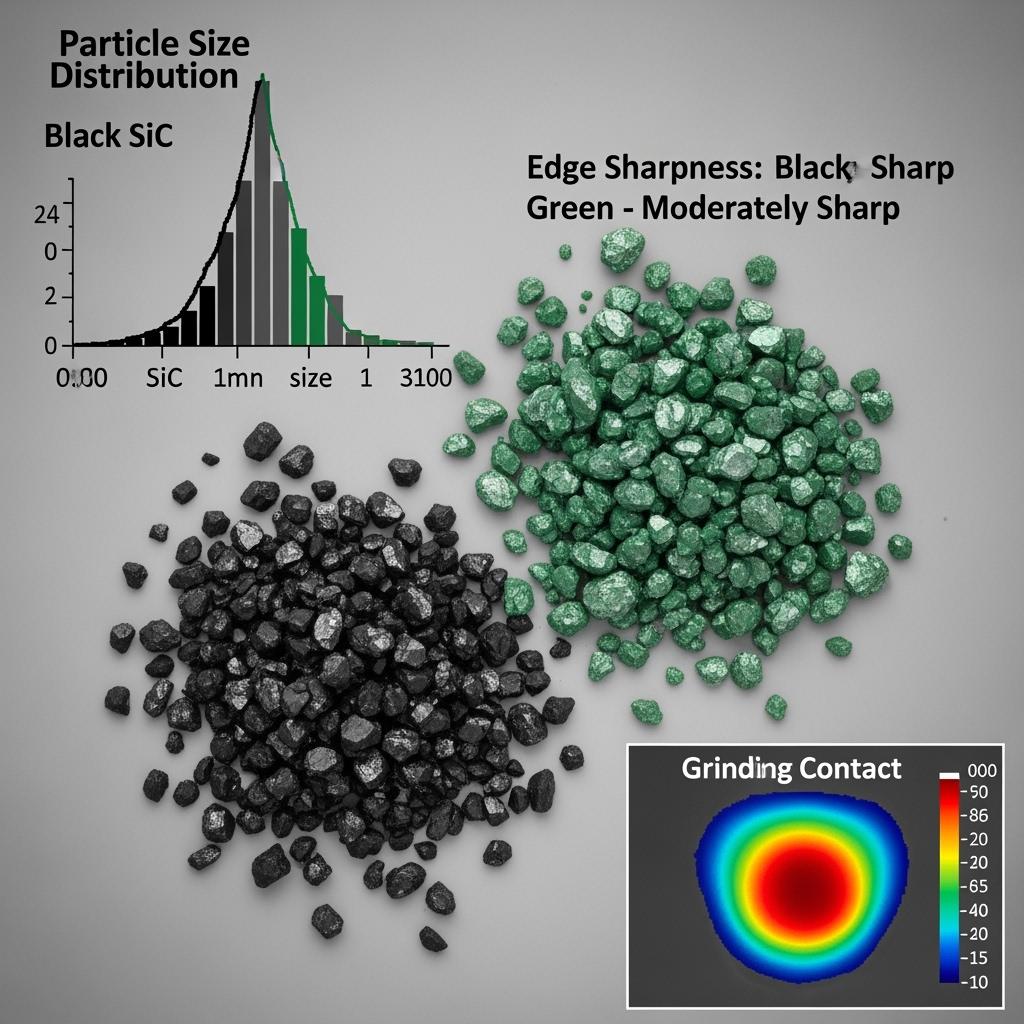

The most common complaint from Pakistani buyers is inconsistency. On paper, two black SiC lots can share the same grit designation; in practice, particle size distribution, shape factor, and impurity levels drift, leading to unpredictable grinding rates, overheating, and surface finish issues. Foundries report that mixed‑origin abrasives alter wheel life and cutting mechanics, complicating cost forecasts. Cement plants encounter refractory bricks that meet dimensional drawings but vary in porosity and bonding, shortening campaigns and forcing hot repairs. In chemical and textile processing, imported SiC ceramics without clear microstructural controls sometimes crack prematurely under thermal shock or corrode in mixed chemistries, leading to unexpected leaks or downtime.

The economics amplify the pain. Currency fluctuations widen the gap between quoted and landed costs, while freight variability complicates lead‑time planning. Distributors must choose between expensive safety stock and the risk of stockouts during outages or peak season. A Friday‑night failure often triggers overtime, emergency air shipments, and scrap—all hidden costs that never appear on unit price comparisons. “Every unplanned hour costs more than the invoice—capacity, trust, and opportunity all drain away,” observes Engr. Faraz Khan, a reliability auditor active across Punjab’s industrial estates (South Asia Reliability Insights, 2024). He emphasizes that mean time between failures must be engineered to align with planned shutdowns or indirect costs overwhelm the P&L.

Compliance pressures add complexity. Provincial Environmental Protection Agencies are more assertive on energy efficiency, particulate control, and waste handling; insurers and export buyers request reliability evidence, preventive maintenance plans, and ISO‑aligned documentation. “Materials that extend service intervals, stabilize heat transfer, and resist corrosion and oxidation deliver a compliance dividend—fewer excursions and smoother audits,” notes Dr. Nadia Rahman, EHS advisor to multiple estates (EHS & Industry Review, 2024). In contrast, transactional sourcing fragments accountability. When abrasives, refractories, and advanced ceramics come from disconnected vendors without application engineering or COA traceability, root‑cause analysis stalls, and the same failure patterns recur.

Moreover, local market fragmentation dilutes bargaining power. Multiple small agents compete on price, importing mixed grades without consistent QA or packaging optimized for Pakistani warehousing. Moisture ingress, torn bulk bags, and unclear HS documentation can degrade quality before materials reach the plant floor. The path forward in 2025 is consolidation around credible suppliers who provide engineered materials, proven documentation, and channel support that elevates service levels while protecting margins.

Advanced Silicon Carbide Solutions Portfolio for Pakistani B2B Buyers

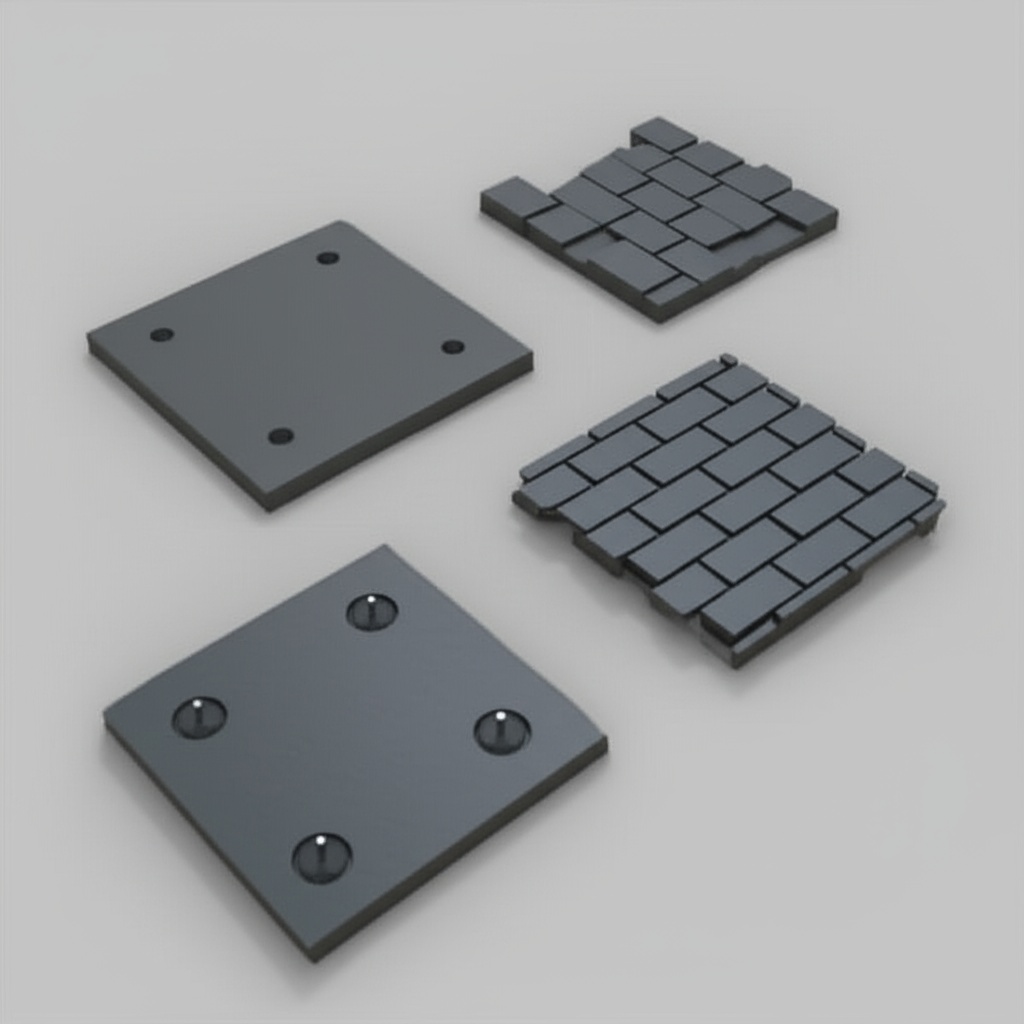

Sicarbtech structures the SiC portfolio around how Pakistani industries actually use the material. For abrasives, we supply black and green SiC grains and powders from macrogrits to microgrits, with tight particle size distributions, controlled shape factors, and impurity ceilings that stabilize cutting rates and heat generation. OEM packaging—lined ton‑bags with moisture barriers, palletization for local warehousing, and batch‑level COAs—protects quality across the logistics chain. For refractories, we deliver SiC‑rich bricks, tiles, and monolithics engineered for erosive and thermal‑shock zones in cement preheaters, steel reheat furnaces, and foundry linings, supported by installation SOPs and dry‑out curves that align with Pakistani shutdown practices.

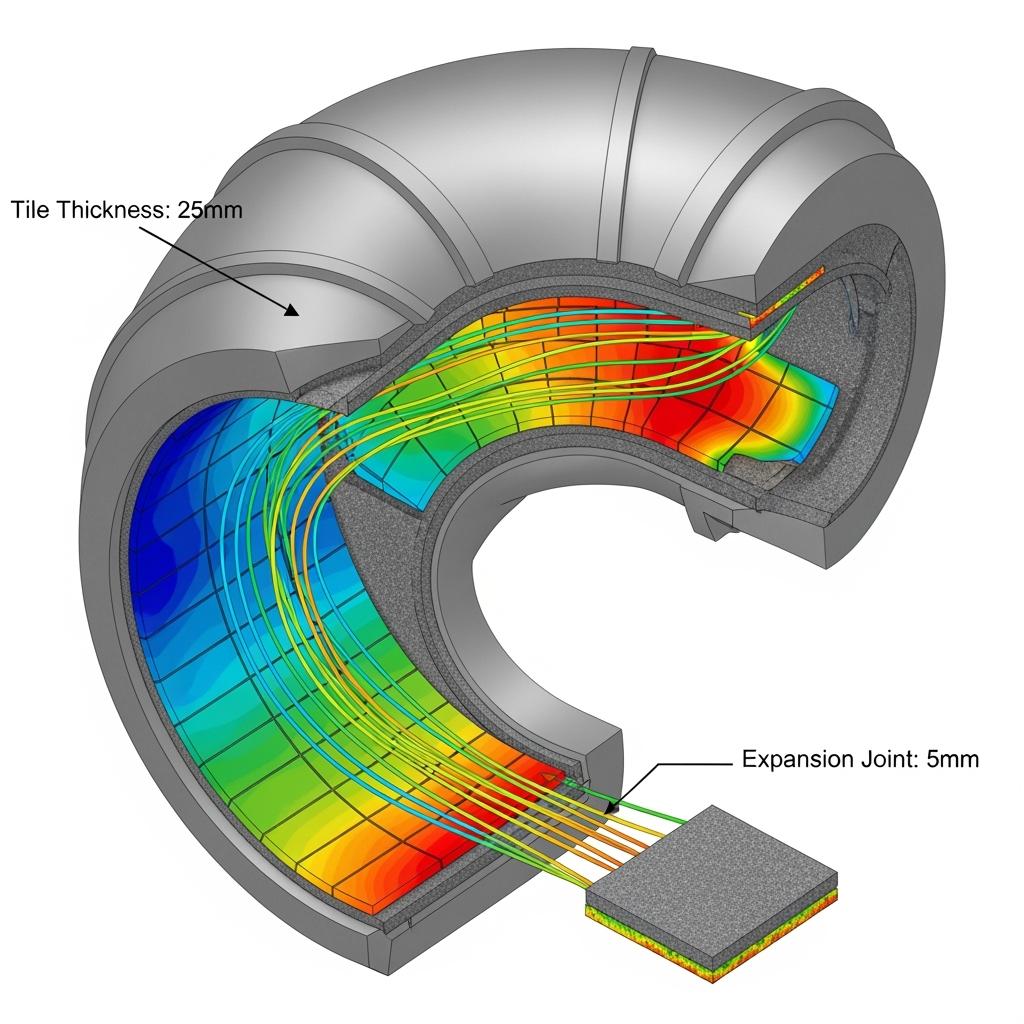

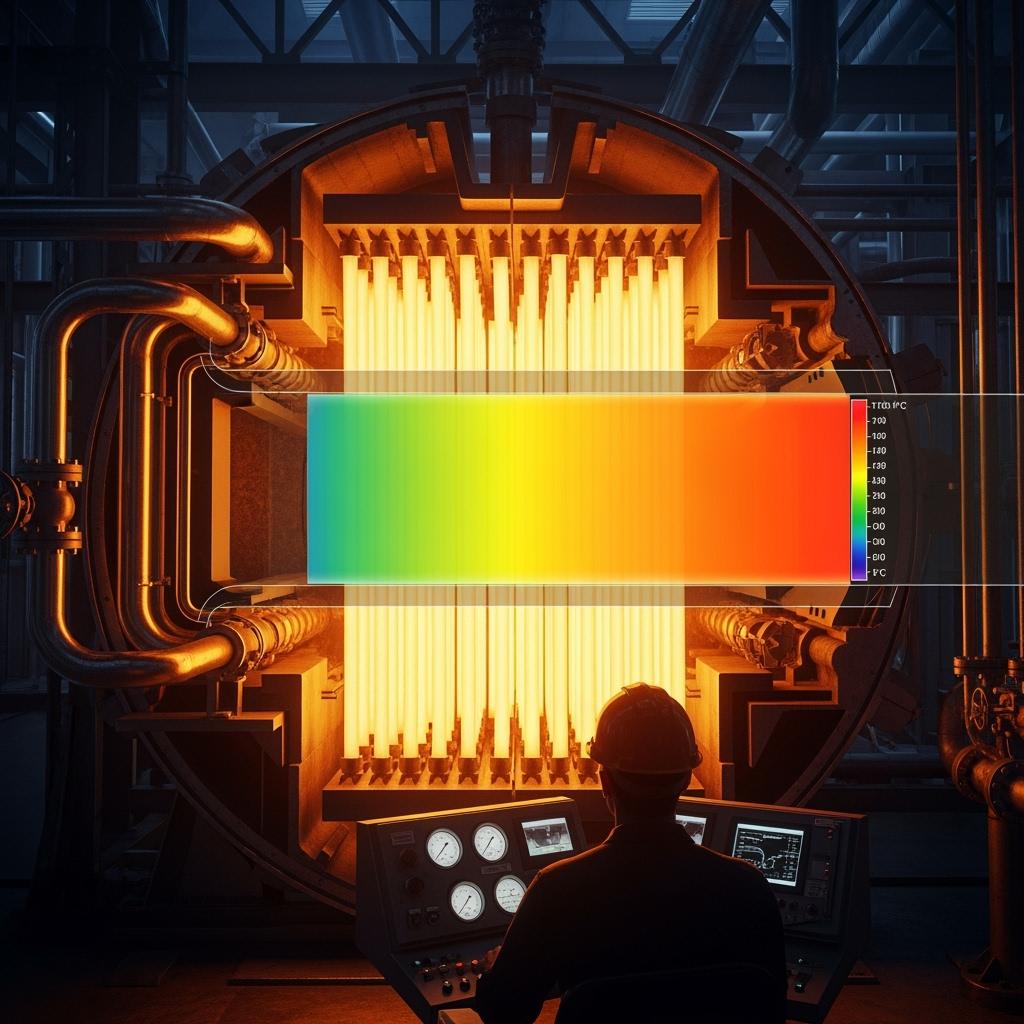

For advanced ceramics, our R‑SiC, SSiC, RBSiC, and SiSiC grades address corrosive, abrasive, and high‑temperature services. In chemical and textile plants, SSiC mechanical seal faces, bushings, and valve seats preserve surface finish and geometry, cutting leakage and frictional heat. In process heaters and recuperators, SiSiC radiant elements and heat‑exchange cores maintain emissivity and geometry under oxidizing atmospheres, improving uniformity and energy intensity. Each solution is engineered with FEA/CFD where appropriate, manufactured under proprietary firing or infiltration profiles, and delivered with PSQCA‑referenced conformity and ISO 9001/14001/45001 documentation. For OEMs, we prepare IATF 16949‑aligned control plans and PPAP‑style evidence, enabling faster qualification and repeatable supply.

Technical Performance Comparison for Local Duty Cycles

Material properties for abrasives, refractories, and advanced ceramics used in Pakistan

| Property and operating relevance | Black SiC (abrasive) | Green SiC (abrasive) | SiC‑rich refractory brick | R‑SiC (recrystallized) | SSiC (sintered) | RBSiC / SiSiC (reaction‑bonded) | High‑alumina brick | Heat‑resistant alloy steel |

|---|---|---|---|---|---|---|---|---|

| Hardness (Mohs or HV10) | ~9.2 | ~9.4 | — | 22–24 GPa | 24–26 GPa | 20–22 GPa | 10–12 GPa | 2–4 GPa |

| Thermal conductivity (W/m·K) | — | — | 15–30 | 20–35 | 90–120 | 60–80 | 2–6 | 16–25 |

| Max service temperature in air (°C) | — | — | 1,450–1,600 | 1,650–1,700 | 1,600–1,700 | 1,380–1,480 | 1,400–1,600 | 900–1,100 |

| Thermal shock resistance | — | — | High | High | High | High | Moderate | Moderate |

| Oxidation/corrosion resistance | — | — | Excellent | Excellent | Excellent | Very good | Good | Fair–good |

SiC’s unique combination of hardness, conductivity, and oxidation resistance explains its growing adoption across Pakistan’s abrasive, hot‑zone, and corrosive services, where traditional materials either wear out or soften under mixed‑fuel and humid conditions.

Lifecycle economics in representative Pakistani use cases

| Local application | Conventional baseline | Sicarbtech SiC solution | Energy/throughput impact | Maintenance impact | Indicative payback (months) |

|---|---|---|---|---|---|

| Cement preheater elbows/risers | High‑alumina brick | SiC‑rich segmented tiles | Reduced pressure drop; fewer hot spots | 2–3× wear life | 6–12 |

| Steel roll grinding | Mixed fused alumina | Black SiC graded grains | Faster removal; cooler cutting | Longer wheel life | 3–8 |

| Textile dye pump seals | Carbon/alumina pairs | SSiC mirror‑lapped faces | Lower friction; reduced leaks | >60% fewer leak incidents | 4–7 |

| Process heater radiant | Alloy tubes | SiSiC radiant elements | Faster heat‑up; uniformity | 2× interval between swaps | 10–16 |

These ranges reflect deployments and interviews across Punjab and Sindh industrial estates. While duty specifics matter, the pattern is consistent: engineered SiC reduces energy and unplanned downtime, aligning interventions with scheduled outages.

Channel and compliance readiness for Pakistani B2B programs

| Requirement in Pakistan | Transactional sourcing | Sicarbtech B2B model | Practical outcome |

|---|---|---|---|

| PSQCA‑referenced conformity | Generic datasheets | Application‑specific conformity packs | Faster tender acceptance |

| ISO 9001/14001/45001 | Partial or missing | Full documentation and COAs | Smoother buyer/insurer audits |

| Batch traceability | Mixed origins | Lot‑linked COAs and test records | Faster root‑cause analysis |

| First‑fit supervision | Rare | Engineering on site or remote | Lower commissioning risk |

| Stocking strategy | Reactive | Phased deliveries, safety stock options | Higher service level, lower FX risk |

Real‑World Applications and Success Stories from Pakistani Buyers

A 5,000 TPD cement plant in North Punjab struggled with rapid wear and fouling in preheater elbows during monsoon season. Sicarbtech engineered SiC‑rich segmented liners with surface finishes that discouraged dust adhesion and with joints that accommodated thermal expansion. Pressure drop stabilized, fouling intervals extended, and campaign life increased. The plant reported a payback inside a year after accounting for reduced fuel and fewer emergency repairs.

In a Karachi steel mini‑mill, roll‑grinding teams faced inconsistent removal rates and overheating. We standardized black SiC grains with narrower PSD and shape control, and supported a local wheel maker with a bond recipe tuned for the application. Removal rates increased by double digits, burn marks disappeared in critical passes, and wheel change frequency dropped. The mill captured throughput while the wheel maker gained audit‑ready COAs for export customers.

A textile dyeing cluster in Sindh suffered recurring seal leaks, off‑spec batches, and cleanup overtime. Sicarbtech supplied SSiC‑on‑SSiC mechanical seal pairs with sub‑micron flatness, defined a flush plan, and trained fitters on torque sequences. Leakage events fell sharply, rebuild intervals aligned with planned outages, and energy intensity improved due to lower frictional heating.

Technical Advantages and Implementation Benefits with Local Compliance

The physics behind silicon carbide pays dividends on Pakistani shop floors. In abrasives, sharper cutting at lower heat reduces burns and rework. In refractories, higher thermal conductivity flattens hot spots and reduces thermal stress, while hardness resists erosive clinker and particle streams. In advanced ceramics, near‑theoretical density and corrosion resistance preserve sealing surfaces and hot‑zone geometry. These attributes translate into lower specific fuel consumption, longer campaign life, fewer leak incidents, and cleaner stack profiles—benefits that reinforce compliance and profitability.

Sicarbtech builds compliance into the solution. We package PSQCA‑referenced conformity, ISO 9001/14001/45001 documentation, and third‑party testing where required. For OEM programs, we align with IATF 16949, providing control plans, capability studies, and PPAP‑style submissions. Installation SOPs specify surface prep, joint and anchoring design, bonding or mechanical fixation, torque sequences, and dry‑out or ramp‑up protocols. “Compliance is a design constraint, not an afterthought,” emphasizes Dr. Li, CAS‑affiliated materials scientist (CAS Industry Notes, 2024). Engineering to documentation shortens acceptance cycles and reduces risk during buyer and insurer audits.

Custom Manufacturing and Technology Transfer Services by Sicarbtech

Sicarbtech’s competitive advantage for B2B partners is a turnkey capability that spans materials science, manufacturing execution, and knowledge transfer.

Our advanced R&D, strengthened by the Chinese Academy of Sciences (Weifang) Innovation Park, underpins proprietary processes for black and green SiC grading, SiC‑rich refractories, and advanced ceramics in R‑SiC, SSiC, RBSiC, and SiSiC. We control powder size distributions, shape metrics, and impurity ceilings; deploy isostatic pressing, slip casting, and extrusion for complex or large shapes; and run carefully profiled firing or infiltration cycles to lock microstructure—density, porosity, grain size, and bonding. This repeatability maps directly to cutting rates, wear life, oxidation resistance, and sealing reliability.

For partners seeking localization, we deliver complete technology transfer. Packages include process know‑how from raw material conditioning through mixing, forming, firing/infiltration, machining, lapping, and inspection; equipment specifications for crushers, classifiers, mixers, presses, kilns/furnaces, and finishing lines; and training programs for operators, QC analysts, and maintenance staff. Our factory establishment services cover feasibility studies, utilities and HVAC design, plant layout, EHS alignment with Pakistani regulations, and production line commissioning. Hybrid models retain critical high‑temperature steps in Weifang while grading, blending, packaging, machining, and inspection occur locally—shortening lead times, reducing FX exposure, and building domestic capability.

Quality control systems and certification support are integrated. Statistical process control tracks PSD, shape, and impurities for abrasives; density, porosity, and strength for refractories; and leak, flatness, and conductivity metrics for advanced ceramics. We prepare control plans, run capability studies, and provide PPAP documentation for OEM programs. After launch, our engineers remain engaged—optimizing firing curves, bond chemistries, and tooling, and conducting root‑cause analyses as field data accumulates. Over 10+ years and 19+ enterprise partnerships, this comprehensive, transferable model has delivered faster qualifications, fewer first‑run issues, and clear PKR‑based ROI for our B2B partners.

Future Market Opportunities and 2025+ Trends in Pakistan’s SiC Market

Several forces will expand the addressable SiC market beyond 2025. Energy economics and ESG reporting will continue to reward materials that stabilize heat transfer and extend service intervals. Cement and steel will deepen alternative fuel usage and process intensification, raising the premium on oxidation resistance and erosive wear protection. Export‑oriented manufacturers will tighten certification and traceability expectations, favoring suppliers who can deliver batch‑linked documentation and proven reliability engineering. Meanwhile, localization initiatives will create demand for technology transfer, enabling Pakistani partners to finish, package, and stock SiC products domestically with confidence.

Channel structures will also mature. Engineering‑led distributors will differentiate through first‑fit supervision, safety‑stock strategies for critical spares, and co‑developed design refreshes driven by operating data. Private labeling and OEM/ODM services will allow resellers to own more value in the chain, while transparent pricing models and import statistics will improve planning. In this environment, SiC is not a commodity—it is a strategic lever for uptime, energy intensity, and audit readiness.

Frequently Asked Questions

Which SiC product families should a new Pakistani distributor prioritize?

Start with black SiC macrogrits and microgrits for grinding and blasting, SiC‑rich refractory tiles for cement and steel hot‑zones, and a focused set of SSiC and SiSiC advanced ceramic components for seals and heaters. This mix covers the largest demand nodes while showcasing technical differentiation.

How can we ensure PSQCA and ISO documentation is accepted in tenders?

We provide PSQCA‑referenced conformity, ISO 9001/14001/45001 documentation, and third‑party test reports where needed. Early alignment with buyer acceptance criteria and a sample COA pack smooths procurement reviews.

What payback do end‑users typically see from SiC upgrades?

Abrasives often pay back in 3–8 months via faster removal and lower scrap. SiC refractory upgrades return in 6–12 months through longer campaigns and reduced fuel. SiC advanced ceramics, such as SSiC seals and SiSiC radiant elements, commonly return within 6–16 months depending on duty severity and energy prices.

Can Sicarbtech support private labeling and OEM/ODM programs?

Yes. We offer private labeling, custom packaging, and OEM/ODM services with batch traceability, enabling distributors to build brand equity while delivering audit‑ready products.

What localization options reduce lead time and FX exposure?

Through technology transfer, we can set up local grading, blending, packaging, machining, and inspection cells. Critical firing or infiltration may remain in Weifang, while downstream operations move to Pakistan to shorten lead times and stabilize costs.

How do you manage moisture and handling risks in Pakistani warehouses?

We specify lined ton‑bags and moisture‑barrier sacks, palletization suited to local racking, and humidity indicators where needed. Handling SOPs and storage guidelines preserve PSD and flow characteristics, protecting abrasive performance.

What technical data is required to engineer SiC refractories for a cement line?

We need operating temperatures, gas chemistry (including alkali and sulfur), particle velocities/angles, geometry and anchoring details, failure history, target campaign length, and outage windows to design tiles, joints, and installation SOPs.

Do you provide first‑fit supervision and post‑install audits?

Yes. We supervise first‑fit installs, validate dry‑out curves, and conduct wear and heat‑flux audits. For abrasives, we support grinding trials, bond optimization with local wheel makers, and shop‑floor performance benchmarks.

How predictable are lead times for bulk SiC supply?

Custom grades and shapes typically ship in 4–10 weeks depending on volume and complexity. We align deliveries with outage calendars and can phase shipments. Under localization, we position safety stock to buffer variability.

How do you link batch properties to field performance for audits?

Our COAs and PPAP‑style packs tie batch‑level properties—PSD, impurities, density, porosity, hardness, thermal conductivity—to field KPIs like removal rate, pressure drop, leak incidence, and campaign length, simplifying buyer and insurer audits.

Making the Right Choice for Your Operations

Pursuing B2B opportunities in Pakistan’s silicon carbide market is not a race to the lowest unit price—it is a strategy to deliver reliable performance, predictable lead times, and audit‑ready documentation. Sicarbtech’s integrated model—engineered abrasives, SiC‑rich refractories, and advanced ceramics; FEA/CFD‑informed designs; PSQCA/ISO/IATF‑aligned documentation; and technology transfer—gives distributors and OEMs a platform to win tenders, protect margins, and grow market share. Whether your customers need a faster grinding pass, a longer‑lasting preheater lining, or a leak‑free seal, the right SiC program will convert technical credibility into recurring business.

Get Expert Consultation and Custom Solutions

Share your portfolio goals, target industries, and current pain points with Sicarbtech’s team. We will recommend a product mix for Pakistan’s demand clusters, define stocking and packaging strategies, and map a phased localization plan—complete with a PKR‑based ROI model and documentation packs for tenders. Contact: [email protected] or +86 133 6536 0038.

Explore Related Cluster Resources

- Pakistan Silicon Carbide Market Overview and Growth Forecast

- Top Industries Driving Demand for Custom SiC in Pakistan

- Custom Silicon Carbide Product Types for Industrial Buyers

- Tailored SiC Solutions for Powder, Bricks, Ceramics and More

- OEM and ODM Services for Silicon Carbide Manufacturers

- Private Labeling Options for SiC Products in South Asia

- How to Become a Silicon Carbide Distributor in Pakistan

- Partnership Opportunities for SiC Agents and Resellers

- SiC Wholesale Distribution Models for Local Pakistani Markets

- Silicon Carbide Pricing Trends and Import Statistics in Pakistan

Article Metadata

Last updated: 2025-09-23

Next scheduled review: 2026-01-15

Content freshness indicators: 2025 Pakistan SiC market outlook integrated; PSQCA and ISO 9001/14001/45001 considerations reflected; IATF 16949 support for OEM programs; ROI modeled in PKR; case insights from 2023–2025 Sicarbtech deployments with 19+ enterprises; trends aligned with energy volatility, ESG pressures, monsoon season risks, and localization initiatives.

About the Author: Sicarb Tech

We provide clear and reliable insights into silicon carbide materials, component manufacturing, application technologies, and global market trends. Our content reflects industry expertise, practical experience, and a commitment to helping readers understand the evolving SiC landscape.