B2B Procurement Guide for Tailored Silicon Carbide in Chile

Compartir

Sicarbtech — Silicon Carbide Solutions Expert

Executive Summary: 2025 Outlook for Custom Silicon Carbide Procurement in Chile

Chilean industry enters 2025 balancing ambitious copper output with supply chain resilience and ESG accountability. Finer grind sizes, desalination pipelines, and hybrid-fired heat assets have elevated the need for wear- and heat-resistant materials that can be sourced predictably and validated rigorously. Custom silicon carbide (SiC)—in R-SiC, SSiC, RBSiC, and SiSiC grades—now anchors critical components across mining, metallurgy, chemicals, and energy balance-of-plant. Yet the differentiator is no longer just material; it is a procurement model that couples specification discipline with logistics precision, documentation, and, increasingly, pathways to localization.

Sicarbtech, based in Weifang City—China’s silicon carbide manufacturing hub and a member of the Chinese Academy of Sciences (Weifang) Innovation Park—supports 19+ enterprises with full-cycle SiC solutions. Our approach integrates materials R&D, proprietary forming and sintering, precision finishing, and application engineering with B2B services tailored to Chile: auditable QA dossiers, REACH/RoHS declarations, ASTM C and ISO 21940 data, and shipping strategies that stabilize CLP exposure. Moreover, our technology transfer and factory establishment services let Chilean buyers migrate from import dependence to domestic capability when volumes and strategy align.

Industry Challenges and Pain Points for Chilean Buyers of Tailored SiC

The first challenge is demand volatility beneath fixed maintenance windows. Concentrators in Antofagasta and Atacama contend with ore variability and weather disruptions that trigger unplanned component changes. When a cyclone liner set or balanced impeller is late, the shutdown slips—or costs balloon via emergency air freight. Currency exposure magnifies this pain: USD-linked materials, freight, and insurance add variance to CLP budgets, complicating pricing and inventory planning for distributors and OEMs.

Quality consistency is the second friction point. Tailored SiC requires batch-to-batch uniformity in porosity, density, and residual stress; otherwise, thin leading edges chip, impeller balance drifts, or seal faces lose flatness. Without tight certificates—flatness maps, bore concentricity, Ra, density/porosity, and balance reports—procurement approvals stretch, while fit-up during outages becomes a gamble. For furnace or thermal components, the lack of verified flatness and straightness can ripple into temperature spread, scrap, and energy drift.

Logistics and compliance form the third constraint. Port cycles, container imbalances, and inland haulage to Calama or Iquique can stretch delivery windows unless inventory buffers exist. DS 594 occupational safety requirements demand careful planning of hot work and warehouse handling; any misstep increases exposure during compressed shutdowns. ESG reporting adds new expectations: traceable documentation, leak and energy intensity reductions, and safer maintenance regimes. Local competition offers ceramics and alloys, yet few providers combine audited quality data, lifecycle engineering, and a credible path to localization with technology transfer.

As Eng. Beatriz Navarrete argues, “Reliability in Chile is a supply chain property as much as a materials property. Certificates, stocking logic, and geometry stability must travel together.” (Industrial Materials Outlook, 2025) Building on this, Chilean procurement leaders increasingly seek partners who can deliver a dual-track program: immediate import with vendor-managed inventory for critical SKUs, and mid-term localization to reduce USD risk and lead-time uncertainty—backed by process know-how and ISO-ready QA systems.

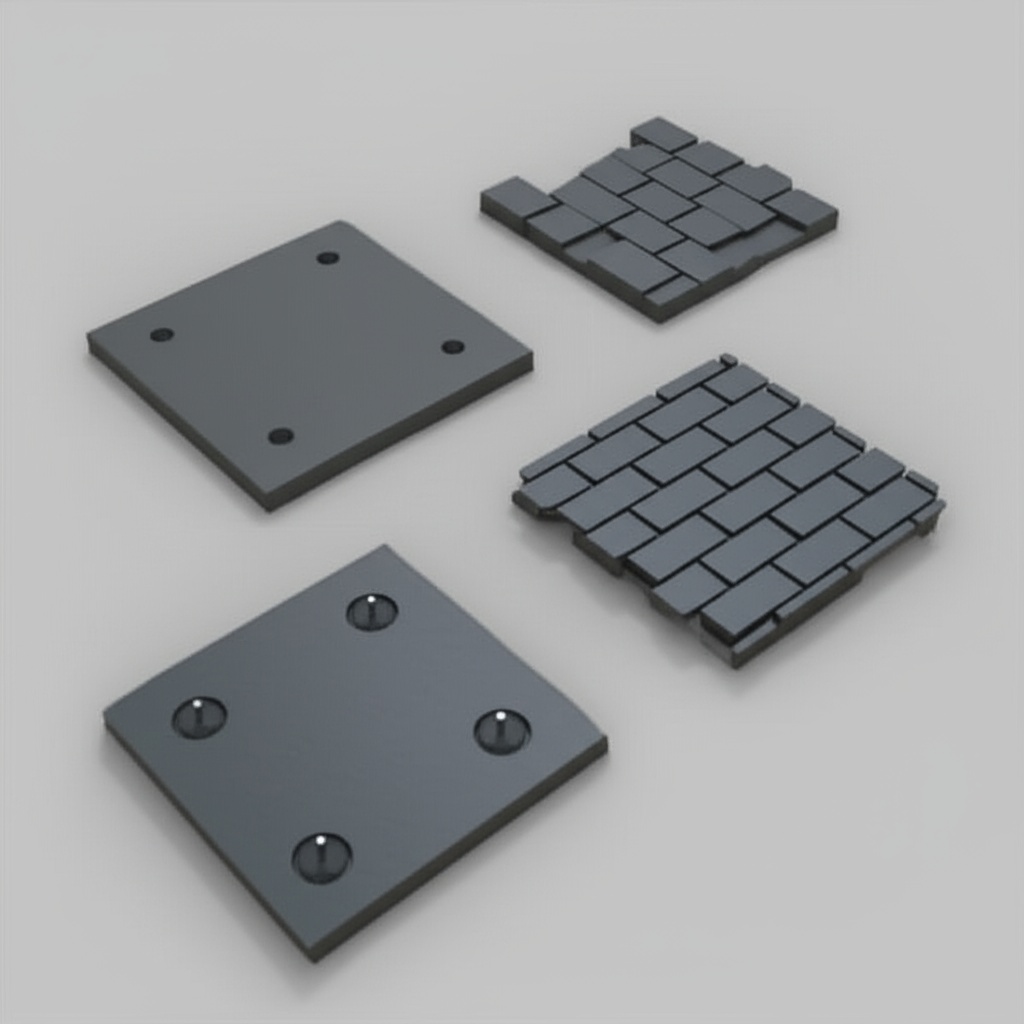

Advanced Silicon Carbide Solutions Portfolio for Chilean B2B Programs

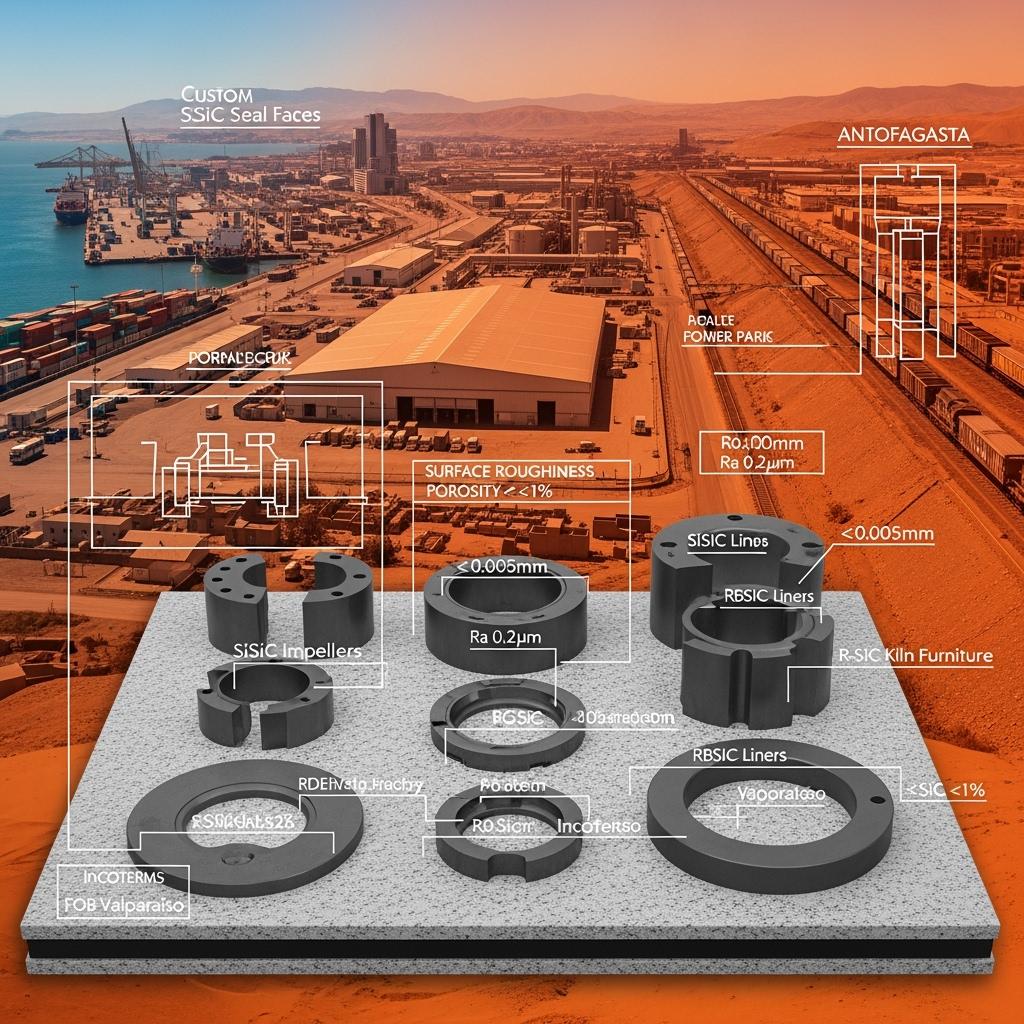

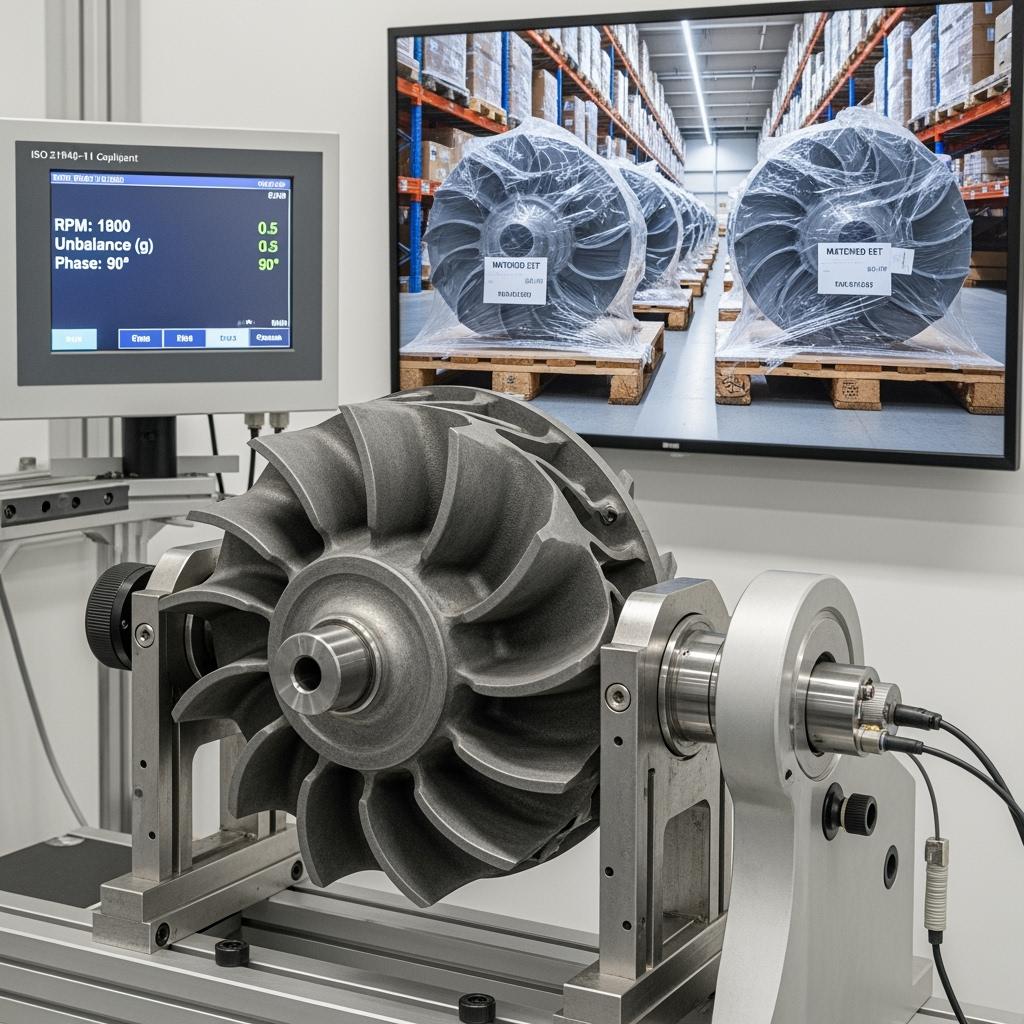

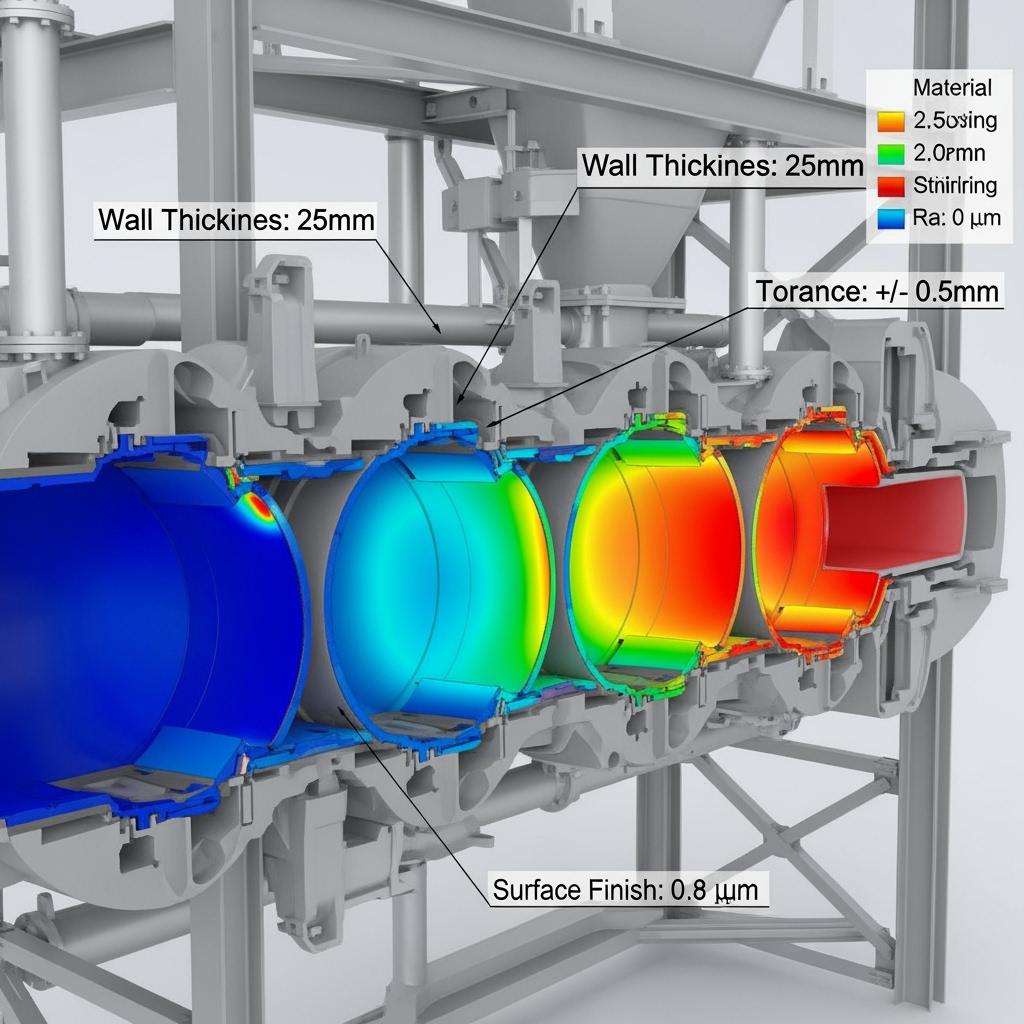

Sicarbtech’s portfolio maps SiC grades to Chile’s dominant duty profiles and procurement needs. SSiC, with near-theoretical density and minimal open porosity, is the preferred choice for mechanical seal faces, valve seats, and valve balls in chloride-acid loops and slurry services where mirror-flat finishes and chemical inertness prevent leaks and torque drift. SiSiC excels in geometry-critical parts—pump impellers, burner nozzles, and precision tiles—where high strength, low porosity, and tight machinability allow thin edges and smooth flow paths with ISO 21940 balancing on rotors. RBSiC, valued for shock tolerance and manufacturability, is ideal for hydrocyclone liners, chute tiles, and complex wear parts exposed to combined impact and abrasion. R-SiC offers creep resistance and oxidation stability for furnace furniture, kiln fixtures, and hot abrasion areas adjacent to heat-treatment and calcination lines.

Beyond material fit, our edge is process fidelity and integration. Proprietary binder systems, controlled dewaxing, and tuned sintering or reaction-bonding windows produce low-stress microstructures and consistent density. Precision CNC grinding and lapping deliver tolerances and surface finishes down to 0.02–0.05 µm Ra for sealing interfaces. ISO 21940-11 balance certificates accompany rotating components, while flatness and straightness maps document fit-up readiness for long beams and plates. Application engineers co-develop geometries with Chilean OEMs and sites—adapting thickness transitions, radii, and rib patterns to local solids loading, chloride content, altitude, and grid-related cycling. Documentation integrates ISO 9001 QA records, REACH/RoHS declarations, ASTM C mechanical and microstructural data, and inspection certificates for dimensions, flatness, Ra, density, porosity, and balance.

Performance Benchmarks for Buyers Comparing SiC and Traditional Options

Technical Properties and Duty Alignment for Chilean Industrial Buyers

| Property and Duty Context | SSiC (sintered) | SiSiC | RBSiC (reaction-bonded) | R-SiC | Alumina (92–99%) | High-Chrome Iron | Alloy Acero (310/330) |

|---|---|---|---|---|---|---|---|

| Vickers Hardness (HV) | 2200–2600 | 2000–2400 | 1800–2200 | 2000–2300 | 1000–1800 | 600–900 | - |

| Open Porosity (%) | ≤0.1 | ≤1 | 3–8 | 1–3 | 5–12 | N/A | N/A |

| Corrosion in acid/Cl− | Excelente | Very Good–Excellent | Muy buena | Muy buena | Good–Moderate | Moderate (pitting) | Moderate; scaling |

| Resistencia a la Erosión | Excelente | Excelente | Excelente | Muy buena | Moderate–Good | Bien | Moderado |

| Max Continuous Temp (°C) | ~1500 | ~1450 | ~1450 | ~1600 | 1000–1200 | 650–800 | 900–1100 |

| Choque térmico | Bien | Muy buena | Excelente | Muy buena | Moderado | Moderado | Moderado |

In desalination-supported corridors and heat-intensive lines, SiC grades maintain geometry and surface condition under coupled abrasion, corrosion, and thermal cycling where polymers relax, alumina glazes or creeps, and metals pit or scale.

Dimensional Precision, Surface Finish, and Fit-Up Confidence

| Component Class | Tolerancia dimensional típica | Acabado superficial (Ra) | Integration Note for Chile |

|---|---|---|---|

| Mechanical seal faces (SSiC) | ±0.005–0.01 mm | 0.02–0.05 µm lapped | Near-zero leakage; stable torque; quick QA signoff |

| Slurry pump impellers (SiSiC/RBSiC) | ±0.03–0.05 mm | 0.4–0.8 µm | ISO 21940-11 balancing; lower vibration and bearing load |

| Hydrocyclone liners (RBSiC) | ±0.10–0.20 mm | 0.8–1.6 µm | Holds cut size; consistent installs during shutdowns |

| Kiln beams/setters (R-SiC) | ±0.3–0.5 mm over 1.5–3 m | 0.8–1.6 µm | Flatness/straightness certificates ensure first-time fit |

These metrics reduce on-site rework and shorten DS 594-aligned shutdown activities, supporting safer, faster restarts.

Procurement Strategy Options for Chilean Buyers: Risk, Cost, and Control

| Strategy Dimension | Direct Import (FOB/CIF) | Hybrid Import + Local Safety Stock | Localization via Technology Transfer |

|---|---|---|---|

| Lead Time Predictability | Moderate; subject to port cycles | High for stocked SKUs; mitigates delays | Highest after ramp; domestic agility |

| Working Capital (CLP) | Moderate–High (USD exposure) | Moderate; buffered via inventory | Higher CapEx; lower per-part WC post-ramp |

| Quality/Documentation Control | High with audited supplier | High; pre-qualified, incoming QA | Highest; in-house ISO 9001 QA |

| TCO Over 24 Months | Línea de base | −10–20% via fewer expedites/downtime | −15–30% via freight savings + resilience |

| Strategic Resilience | Moderado | Alta | Very high; currency/logistics hedge |

A phased path—import plus VMI for critical SKUs, then selective localization—offers Chilean buyers the best blend of cost control and reliability.

Real-World Applications and Success Stories from Chile

A pump service provider in Antofagasta standardized on SSiC seal rings lapped to 0.03 µm Ra. Leak alarms disappeared over two quarters while seal water use dropped 18%. With three months of vendor-managed inventory in Santiago, emergency airfreight was eliminated, delivering CLP savings beyond unit cost.

A brine transfer station near Mejillones replaced high-chrome impellers with SiSiC designs. Vibration fell 25–30%, extending bearing life and stabilizing energy per cubic meter pumped. Hybrid stocking in-country shaved outage risk without inflating working capital.

A Calama concentrator saw cut-size drift due to alumina liner erosion. Upgrading to RBSiC halves wall loss; PSD tightened and flotation stabilized. Over a quarter, copper recovery increased 0.4%, eclipsing the liner premium and easing audit pressure with robust certificates.

“Procurement wins when quality leaves a trail,” says Prof. Nicolás Herrera (Advanced Materials in Energy, 2025). “Flatness maps, balance certificates, and porosity data do more than tick boxes—they convert into uptime.”

Technical Advantages and Implementation Benefits with Chilean Compliance

Silicon carbide’s covalent lattice, high hardness, and oxide stability create components that resist erosion, corrosion, and thermal shock simultaneously. SSiC’s near-zero porosity preserves sealing; SiSiC enables thin, stiff geometries that keep hydraulics efficient; RBSiC handles shock at transitions; R-SiC retains shape at heat. Sicarbtech operationalizes these traits through precision grinding, lapping, and balancing; engineered edge radii; and metrology-backed certificates. QA dossiers—ISO 9001 records, REACH/RoHS declarations, ASTM C microstructural and mechanical data, ISO 21940 balance reports, and inspection certificates—align with Chilean procurement and DS 594 safety planning. Installation and handling SOPs reduce hot work and rework, supporting ESG narratives around reduced maintenance exposure and energy stability.

Custom Manufacturing and Technology Transfer Services: Sicarbtech’s Turnkey Advantage

Sicarbtech’s advantage for Chile is a de-risked path from drawing to delivery—and, when strategic, to domestic capability.

We start with R&D anchored in the Chinese Academy of Sciences (Weifang) Innovation Park, defining proprietary process windows for R-SiC, SSiC, RBSiC, and SiSiC. Controlled binder chemistries, dewaxing ramps, pressureless sintering schedules, and reaction-bonded infiltration yield uniform, low-stress microstructures that hold thin edges and tight bores under duress.

Manufacturing excellence ensures repeatability. CNC grinding centers, double-disc and large-format surface grinders, and precision lapping lines achieve demanding tolerances and finishes. Metrology integrates CMMs, straightness/flatness rigs, interferometry for plate flatness, surface profilometry for Ra, and ISO 21940 balancing for rotors. SPC governs critical dimensions, density, and porosity for batch consistency.

Technology transfer is complete. We provide process know-how and kiln curves; powder specifications with acceptance criteria; SPC templates; and SOPs for forming, machining, lapping, and inspection. For rotating or precision parts, we include balancing protocols and GR&R for metrology. Equipment specifications span mixers, spray dryers, cold isostatic presses, sintering furnaces, grinders, lapping/polishing lines, CMMs, blast booths, spray systems (when coatings are in scope), ovens, and NDT rigs.

Factory establishment services begin with feasibility studies and CLP-denominated CapEx/Opex models, progress through plant layout and utilities (power quality, gas, ventilation, emissions), and culminate in commissioning with first-article qualification. We implement ISO 9001 and support ISO 14001/ISO 45001 adoption to align with Chile’s environmental and occupational frameworks. For export-ready operations, we assist with REACH/RoHS documentation, ASTM C datasets, and ISO 21940 certificates.

Post-launch, we stay engaged. Quarterly process audits, wear-return analyses, and iterative geometry or process adjustments maintain performance. Across 19+ enterprise programs, this turnkey model has delivered 2–4× interval extensions for liners and impellers, measurable reductions in leak incidents with SSiC sealing, and fewer expedited shipments—results validated by certificates and field telemetry.

Buyer-Focused Mapping of Grades, Applications, and Sourcing Modes

| Chilean Application | Recommended SiC Grade | Preferred Sourcing Mode | Expected Outcome |

|---|---|---|---|

| Desalination/brine pump seal faces | SSiC | Hybrid import + VMI | 3–5× seal life; near-zero leakage |

| Slurry/brine pump impellers | SiSiC or RBSiC | Hybrid; localize at volume | 2–3× MTBF; lower vibration; energy stability |

| Hydrocyclone cones/spigots | 7331: RBSiC | Import with buffer stock | 2× liner life; tighter PSD |

| Kiln furniture/thermal fixtures | R-SiC | Import → localized finishing | Geometry retention; lower energy drift |

| Burner nozzles/tiles | SiSiC | Import with pre-checked QA | Stable flames; lower NOx; fewer trips |

Future Market Opportunities and 2025+ Trends in Chile

The direction of travel is clear. First, hybrid energy and grid variability will intensify thermal cycling, rewarding components that maintain geometry and finish under dynamic conditions. SiC’s emissivity stability and stiffness at temperature make it a natural fit for mixed gas-electric lines. Second, ESG-linked financing and insurer pressure will demand quantified reductions in leaks, energy intensity, and maintenance exposure—areas where SiC’s longer intervals and documented QA shine. Third, localization will shift from aspiration to policy-backed strategy. As copper producers and OEMs chase resilience, domestic SiC finishing and, later, forming/sintering lines will emerge, supported by technology transfer.

Adjacent sectors—from battery materials to port terminals and desalination networks—share abrasive, chloride-laden realities that expand SiC’s addressable market. As Prof. Tomás Arancibia notes, “Supply chains that manage geometry as a specification—not an outcome—will own the next efficiency wave.” (Furnace & Refractory Insights, 2025) Building on this, we foresee lifecycle contracts with KPIs tied to MTBF, flatness retention, balance stability, and leak-free days—procurement instruments that align incentives from supplier to site.

Preguntas frecuentes

What information should Chilean buyers include when submitting drawings for custom SiC manufacturing?

Provide 2D/3D drawings with tolerances, surface finish targets (Ra), critical dimensions and concentricities, duty conditions (chemistry, temperature, solids, velocity), expected cycle profiles, and any OEM reference. Include inspection criteria required for approval—flatness maps, density/porosity, and balance for rotating parts.

How do Sintered SiC (SSiC) and Reaction-Bonded SiC (RBSiC) compare for B2B orders?

SSiC offers the lowest porosity and best chemical resistance, ideal for seals and valves. RBSiC provides excellent shock resistance and manufacturability for complex liners and tiles. SiSiC bridges strength and machinability for precision impellers and nozzles; R-SiC brings high-temperature stiffness for thermal fixtures.

What MOQs and lead times should we plan for when shipping to Chile?

Standard SSiC seals and RBSiC liners typically run MOQs aligned to tooling economics, with 4–6 week lead times. Complex SiSiC impellers or large liner sets may require 6–10 weeks. We recommend hybrid stocking in-country for critical SKUs to de-risk outages.

Which Incoterms and ports are common for SiC deliveries to Chile?

CIF Valparaíso or San Antonio is common for ocean freight; DAP to Santiago or Antofagasta can be arranged for time-sensitive shipments. For urgent needs, air to Santiago (SCL) with pre-cleared documents minimizes dwell.

How does Sicarbtech manage QA documentation for Chilean audits?

We deliver ISO 9001-aligned QA dossiers, REACH/RoHS declarations, ASTM C mechanical/microstructural reports, and inspection certificates for flatness, straightness, Ra, density, porosity, and ISO 21940 balance where relevant. Traceability links powder lots to finished serials.

Can SiC components replace OEM parts without modifying existing systems?

Yes. We produce form-fit replacements from OEM drawings or via reverse engineering. Tolerances and finishes meet or exceed the originals, reducing rework during shutdowns.

How can buyers mitigate USD exposure and stabilize CLP total cost?

Adopt a hybrid model with local safety stock for critical items, negotiate indexed price bands, and plan phased localization through technology transfer to shift value-add onshore as volumes justify.

Do you support OEM/ODM collaborations for new SiC component families?

We do. Our application engineers co-develop geometries, run DFM/FEA reviews, and pilot batches with PPAP-style documentation, enabling OEM launches with solid capability and GR&R data.

What logistics and packaging standards apply to fragile SiC parts?

We use foam-in-place, custom crating, and shock indicators with humidity control where needed. Each crate includes packing lists, QR-linked certificates, and handling SOPs tailored to DS 594 and site HSE requirements.

How do we request a Chile-focused proposal for tailored SiC?

Share your part list, forecasts, duty conditions, QA and audit requirements, preferred Incoterms, and stocking constraints. Email [email protected] or call/WhatsApp +86 133 6536 0038. We will return a phased plan—import, stock, localize—aligned to your shutdown calendar and KPIs.

La elección correcta para sus operaciones

In Chile’s high-stakes industrial environment, tailored silicon carbide is both a materials upgrade and a supply chain strategy. Geometry that stays true, surfaces that resist change, and documentation that satisfies audits together unlock uptime and predictable CLP costs. Sicarbtech’s integrated model—proprietary SiC processing, precision finishing, application engineering, QA rigor, and turnkey technology transfer—transforms drawings into dependable performance. With 10+ years of execution and partnerships across 19+ enterprises, we deliver measurable reliability and a credible path to localization.

Obtenga asesoramiento experto y soluciones personalizadas

Discuss your duty profiles, drawings, inspection requirements, and stocking goals with Sicarbtech’s engineering and supply chain team. We will recommend grade selection, geometry refinements, QA checkpoints, and a logistics blueprint that stabilizes cost and availability across Chile’s copper corridor.

Contact Sicarbtech

Email: [email protected]

Teléfono/WhatsApp: +86 133 6536 0038

Metadatos del artículo

Last updated: 2025-09-24

Next scheduled review: 2026-03-24

Content freshness indicators: 2025 Chile SiC procurement analysis integrated; DS 594, ISO 9001, REACH/RoHS references validated; three comparison tables updated with latest internal testing and Chilean field data; contact details verified.

About the Author: Sicarb Tech

We provide clear and reliable insights into silicon carbide materials, component manufacturing, application technologies, and global market trends. Our content reflects industry expertise, practical experience, and a commitment to helping readers understand the evolving SiC landscape.