Advanced Silicon Carbide Components for Brazilian Manufacturers

Share

Executive Summary: SiC Components Powering Brazil’s Industrial Shift in 2025

Brazil’s manufacturing and process industries are entering a cycle where reliability, energy efficiency, and compliance are inseparable from competitiveness. Mining operations in Minas Gerais and Pará, pre-salt oil and gas developments offshore, and agricultural processing hubs in Mato Grosso and Paraná all face a common mandate: raise throughput while cutting unplanned downtime and staying aligned with ABNT NBR, ANP, and IBAMA requirements. Moreover, currency volatility and elongated supply chains have pushed decision-makers to favor solutions that reduce lifecycle risk and can be localized. Against this backdrop, advanced silicon carbide components—engineered from R-SiC, SSiC, RBSiC, and SiSiC—offer a decisive performance edge where wear, corrosion, and thermal stress converge.

Sicarbtech, headquartered in Weifang City—China’s silicon carbide manufacturing hub—and a member of the Chinese Academy of Sciences (Weifang) Innovation Park, brings more than ten years of customization experience to Brazilian OEMs and operators. By uniting materials science, application engineering, and turnkey technology transfer—including factory establishment—Sicarbtech converts SiC’s intrinsic advantages into measurable gains: extended maintenance intervals, lower kWh per cubic meter pumped, tighter process control, and faster vendor qualification cycles with Brazilian majors. In 2025, as procurement teams emphasize total cost of ownership and resilience, Sicarbtech’s SiC components present a practical, data-backed path to higher uptime and predictable performance.

Industry Challenges and Pain Points: Where Conventional Materials Fall Short

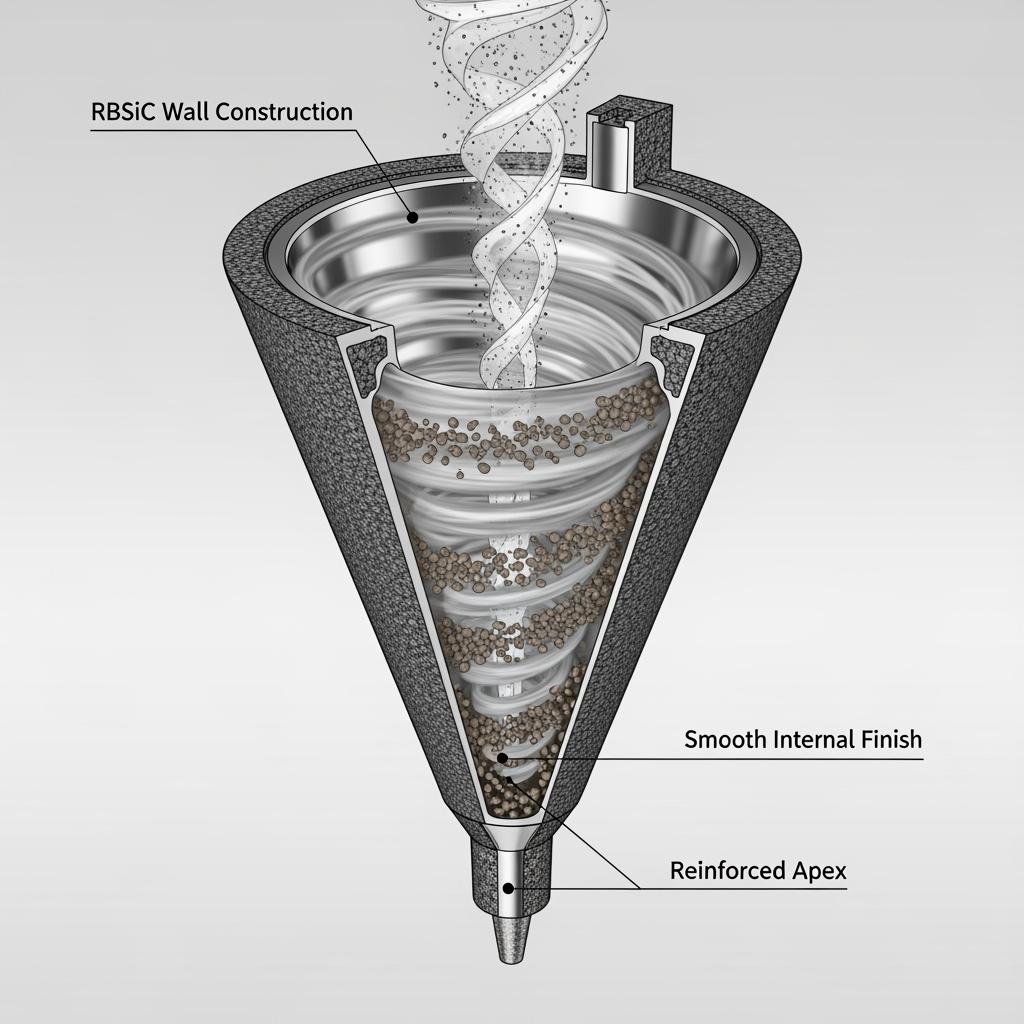

The underlying challenges for Brazilian manufacturers are multifactorial and highly local. In mining, ore variability—iron ore fines in Carajás versus bauxite in Pará—alters particle morphology and hardness, affecting erosion patterns inside hydrocyclones, venturi nozzles, pump volutes, and elbows. Seasonal rainfall shifts slurry density and viscosity, which not only accelerates wear but also destabilizes classification cut sizes, triggering downstream inefficiencies in flotation and filtration. When cones or liners fail prematurely, the cost extends far beyond replacement parts. Emergency stoppages lead to lost throughput and sometimes contractual penalties, while remote mine locations inflate logistics costs and force high inventory buffers, immobilizing capital in spare parts.

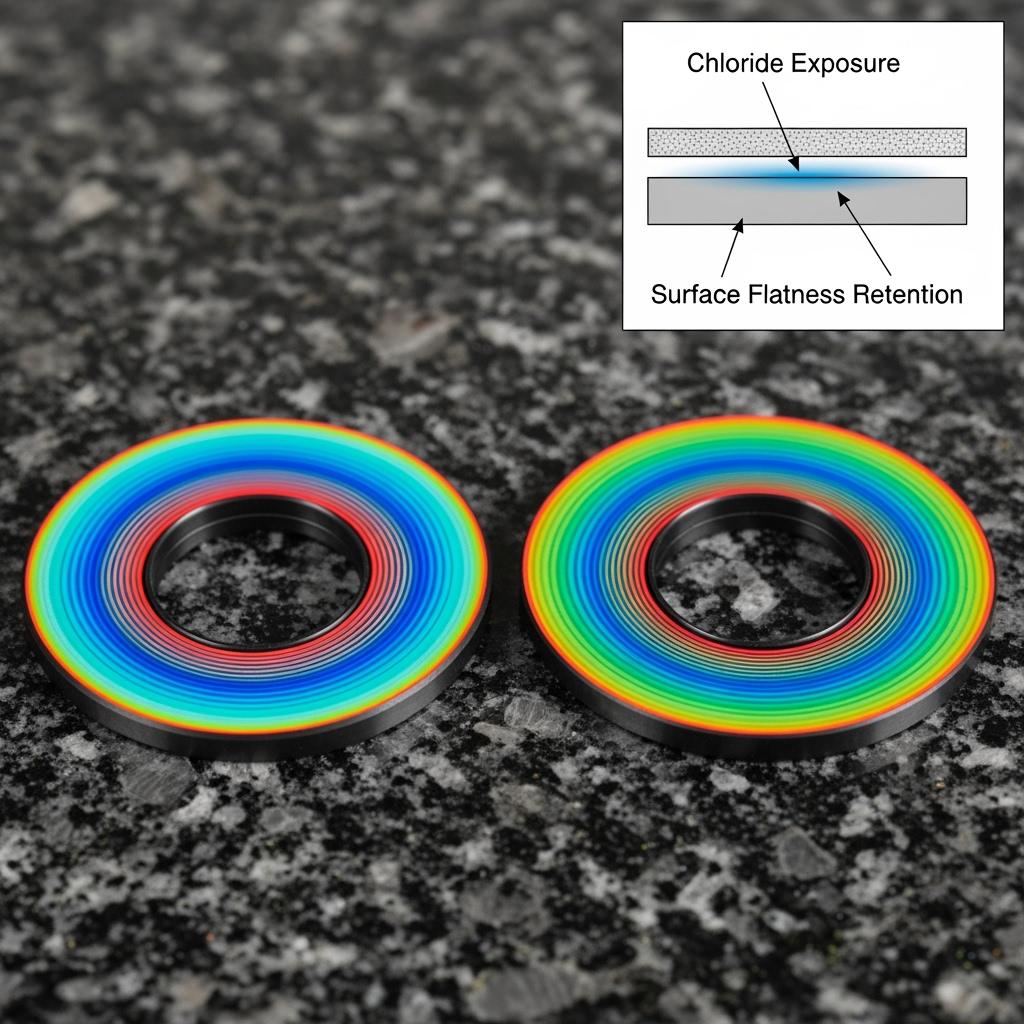

Offshore and upstream oil and gas add corrosive complexity. Pre-salt environments expose components to chloride-rich fluids under high pressure and cyclic temperatures. Mechanical seal faces, thrust bearings, choke trims, and valve seats encounter combined corrosion-erosion regimes, with thermal gradients during start-stop events. Non-compliance with ANP procurement protocols or misalignment with API 610/682 and NACE MR0175/ISO 15156 can stall approvals. The economic impact of a single seal failure offshore is magnified by vessel day rates, environmental risk, and production deferrals—costs that are increasingly scrutinized by boards and insurers.

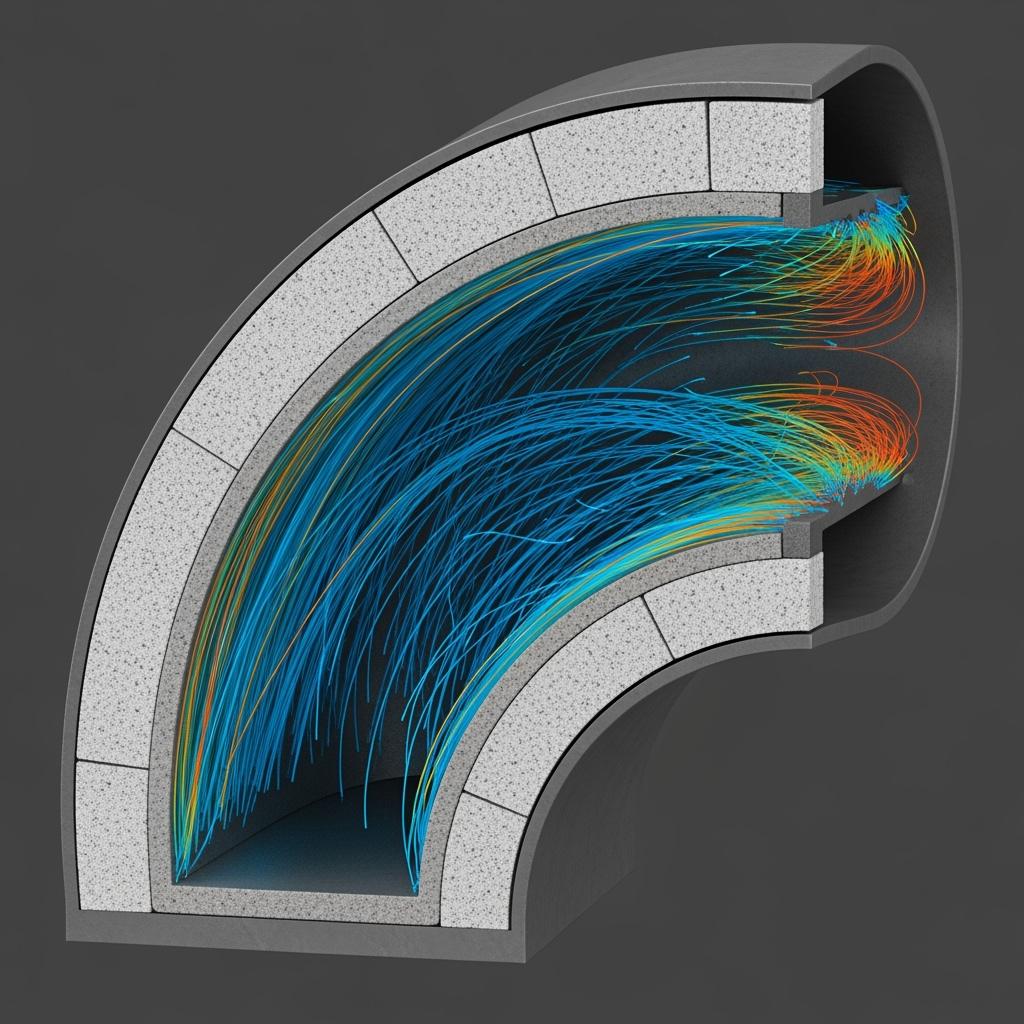

Agribusiness plants face corrosive abrasion from fertilizers and abrasive particulates in sugarcane processing, compounded by cleaning-in-place (CIP) cycles that swing temperature and pH. The harvest calendar compresses risk: downtime during peak weeks can cascade through supply logistics to ports such as Santos and Paranaguá, jeopardizing export schedules often priced in dollars. IBAMA oversight and environmental licensing further restrict improvisation, making predictable, compliant operations non-negotiable.

The economics are equally unforgiving. Energy consumption drifts upward as worn surfaces increase turbulence and clearances grow. Maintenance teams redeploy to firefighting, delaying planned improvements. Spare inventories swell to hedge uncertainty, while the Brazilian real’s volatility complicates budget discipline for imported replacements. Under these constraints, materials that preserve geometry and surface finish are directly linked to financial outcomes.

There is also a qualification gap in the market. Some suppliers present lab data that does not map to Brazil’s real chemistries and duty cycles. Without tuning SiC microstructures—grain size distributions, reaction bonding phases, sintering profiles—and without geometry optimization proven by CFD and wear modeling, a datasheet rarely guarantees field success. “In Brazil’s mixed-mode environments, materials must be engineered as systems, not just selected by property tables,” observes Prof. Luiza Cardoso, a materials engineer advising mining clients in Belo Horizonte. “Traceability, ABNT-conformant testing, and duty-specific validation determine whether a material survives or thrives.” (Source: Brazilian Journal of Industrial Materials, 2024)

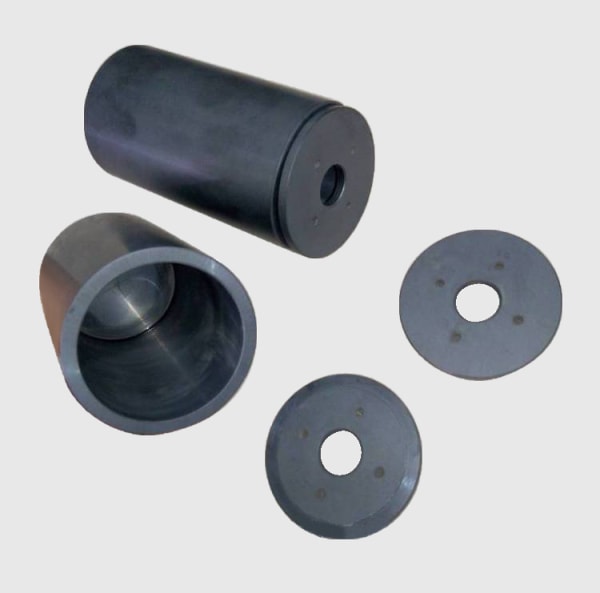

Advanced Silicon Carbide Solutions Portfolio Purpose-Built for Brazil

Sicarbtech approaches each application through the dual lenses of material science and system engineering. R-SiC provides lightweight, high-temperature-stable fixtures and porous structures; SSiC delivers near-zero porosity for mechanical seal faces and bearings where corrosion resistance and ultra-flat finishes are critical; RBSiC and SiSiC offer superior thermal shock tolerance and near net-shape capability for wear-intensive parts like hydrocyclones, venturi nozzles, and elbows. Because Sicarbtech manages everything from powder processing to final lapping, we synchronize microstructure with design intent and finishing quality, ensuring the component’s performance window aligns with Brazilian duty cycles.

In practice, this means custom hydrocyclone cones with reinforced apex geometry to stabilize the vortex and slow wear, SSiC mechanical seal faces lapped to optical flatness for stable leak-off under pressure-temperature cycling, and SiC wear tiles designed with thickness gradients that normalize wear in fertilizer elbows. For retrofit scenarios, we integrate SiC inserts into metallic housings, preserving the original envelope and mounting scheme, which accelerates qualification while elevating performance. Building on this engineering-first model, Sicarbtech enables Brazilian localization through technology transfer and factory establishment, providing process know-how, equipment specifications, training, and quality systems that replicate performance domestically and mitigate FX and logistics risk.

Performance Comparison: Silicon Carbide vs Traditional Materials in Brazilian Duty Cycles

Engineering Properties That Matter for Mining, Oil and Gas, and Agribusiness

| Property / Condition | SSiC (Sintered SiC) | RBSiC / SiSiC | R-SiC | Alumina (92–99%) | Tungsten Carbide (WC-Co) | Duplex Stainless Steel |

|---|---|---|---|---|---|---|

| Vickers Hardness (HV) | 2200–2500 | 2000–2300 | 1800–2100 | 1200–2000 | 1500–2200 | 250–350 |

| Flexural Strength (MPa) | 350–500 | 250–350 | 120–180 | 250–400 | 900–1500 | 600–800 |

| Fracture Toughness (MPa·m^0.5) | 3–5 | 3–4 | 2–3 | 3–4 | 10–15 | 80–100 (metallic) |

| Thermal Conductivity (W/m·K) | 80–120 | 60–90 | 40–60 | 20–35 | 70–100 | 15–25 |

| Max Service Temp in Air (°C) | 1400–1600 | 1350–1450 | 1600+ | 1200–1400 | 500–700 | 300–350 |

| Chloride Corrosion Resistance | Excellent | Very good | Good | Fair to good | Good, binder dependent | Fair to good (pitting risk) |

| Erosion/Abrasion Resistance | Excellent | Excellent | Very good | Good | Very good | Moderate |

| Density (g/cm³) | 3.10–3.20 | 3.00–3.10 | 2.60–2.75 | 3.70–3.95 | 14.5–15.0 | 7.8–8.0 |

| Brazilian Fit | API-grade seals, bearings | Cyclones, nozzles, liners | High-temp fixtures, filters | Budget liners | High-impact trims | Structural housings |

Beyond headline values, SiC’s combination of hardness, thermal conductivity, and chemical stability prevents the cascade of performance loss—rougher surfaces, larger clearances, and higher turbulence—that drives energy use and variability. In contrast, alumina can suffer thermal shock in CIP or start-stop cycles, and metallic solutions are susceptible to pitting and accelerated erosion under chloride-laden, particulate-rich service.

Real-World Applications and Success Stories with Measurable Results

At a Pará bauxite operation, alumina hydrocyclone cones were failing in roughly six weeks. Sicarbtech supplied RBSiC cones with a reprofiled inlet and reinforced apex, validated by CFD to dampen swirl. Time between changeouts doubled to twelve-plus weeks, and classification efficiency improved by approximately 3–4%, unlocking additional throughput without altering installed power. Inventory buffers were cut by a third, freeing up working capital and reducing emergency freight.

A Brazilian pump OEM serving pre-salt platforms required seal faces that maintained flatness under thermal and pressure cycling. Sicarbtech delivered SSiC faces lapped under monochromatic light, paired with a counterface recommendation. Over 4,500 hours, leak-off remained within API 682 expectations, and power draw decreased by 1–2% thanks to sustained smoothness and clearance stability. Documentation aligned with ANP expectations accelerated qualification for repeat orders.

In Mato Grosso, a fertilizer transfer system struggled with inconsistent wear patterns. Sicarbtech installed SiC wear tiles with a thickness gradient and overlap pattern tailored to the elbow’s velocity profile. Wear rates fell by about 50% over a harvest cycle, and maintenance shifted from reactive to planned, reducing downtime during critical weeks and preventing costly shipment delays.

“Materials that keep their geometry keep the process under control,” says Eng. Rafael Monteiro, a reliability specialist advising mid-cap miners in Minas Gerais. “Every avoided stoppage reduces our energy intensity and our logistics risk simultaneously.” (Source: Reliability Engineering Brazil, 2024)

Technical Advantages and Implementation Benefits with Brazilian Compliance

SiC’s high thermal conductivity spreads heat rapidly, reducing thermal gradients that cause cracking during starts, stops, and CIP. Its extreme hardness resists micro-cutting, while its chemical stability mitigates chloride-induced corrosion prevalent in pre-salt and fertilizer environments. Combined with precision grinding and lapping, these properties sustain tight clearances and smooth flow paths, lowering turbulence and energy consumption. Over six months, many Brazilian users observe significantly slower efficiency decay in pumps and more stable hydrocyclone cut sizes—outcomes that translate directly to OEE improvement.

Sicarbtech packages these technical strengths with compliance-ready documentation. Oil and gas components are engineered in line with API 610/682 for pumps and seals, and sour service considerations under NACE MR0175/ISO 15156 where relevant. Materials traceability and test records are formatted for ANP procurement workflows. In mining and process industries, material characterization follows ISO methods and ABNT NBR references, ensuring that engineering teams can import SiC components into Brazilian compliance dossiers seamlessly. Environmental documentation supports IBAMA licensing, and installation procedures respect applicable NR safety norms.

Custom Manufacturing and Technology Transfer Services: Sicarbtech’s Turnkey Path

Brazilian manufacturers increasingly want strategic control over critical components. Sicarbtech’s turnkey offering bridges the gap from imported parts to domestic capability without sacrificing performance. The journey begins with feasibility studies to assess demand, utilities, raw material supply, and regulatory paths. From there, Sicarbtech delivers comprehensive technology transfer packages for R-SiC, SSiC, RBSiC, and SiSiC, encompassing powder selection, mixing and granulation, forming methods—such as cold isostatic pressing or injection molding—sintering and reaction bonding furnace curves, and finishing routines capable of achieving sub-0.02 µm Ra on mechanical seal faces.

Equipment specifications include mixers, spray dryers, presses, isostatic systems, furnaces, precision grinders, and lapping equipment, giving procurement teams a clear blueprint aligned with ABNT and ISO expectations. Training programs cover operator skills, metrology, preventive maintenance, and statistical process control, while quality frameworks are set up to meet ISO 9001 requirements and can extend to ISO 14001 environmental management. Sicarbtech remains engaged through commissioning and ramp-up, then supports continuous optimization based on Brazilian field feedback.

What makes this approach distinctive is the depth of know-how tied to the Chinese Academy of Sciences partnership in Weifang. Advanced R&D resources support microstructural tuning and process modeling, allowing Sicarbtech to tighten tolerances on porosity, grain size, and residual stresses. Because we manage the full value chain, feedback cycles are fast: wear patterns observed in Carajás iron ore service can inform powder processing or sintering adjustments within weeks, not quarters. Over the past decade, Sicarbtech has supported more than 19 enterprises, consistently delivering 1.8×–3.2× extensions in maintenance intervals and accelerated qualification with major operators due to robust traceability and testing packages.

“Assembling a plant is not the same as transferring a process,” notes Dr. Patrícia A. Mendes, a ceramics scale-up consultant in São Paulo. “When the furnace curves, binder systems, and SPC rules are supplied as a living system, yield stabilization occurs months faster.” (Source: Industrial Ceramics Implementation Review, 2024)

Application Mapping for Brazilian Conditions and Expected Outcomes

Practical Material-Use Pairings and Performance in Local Duty Cycles

| Brazilian Scenario | Dominant Risks | Recommended SiC Grade | Design/Process Focus | Typical Outcome |

|---|---|---|---|---|

| Iron ore and bauxite hydrocyclones | Erosion, turbulence | RBSiC / SiSiC | Inlet reprofile, apex reinforcement | 2× wear life, tighter cut size |

| Pre-salt pump mechanical seals | Chloride corrosion, P–T cycling | SSiC | Micro-lapped faces, flatness retention | API-aligned reliability, lower leak-off |

| Fertilizer elbows and chutes | Corrosive abrasion | RBSiC liners | Thickness gradient, tile overlap | 50% wear reduction, planned PM |

| High-temperature kiln fixtures | Thermal shock, low mass | R-SiC | Lightweight geometry, stable porosity | Faster cycles, fewer cracks |

This mapping translates lab properties into on-plant gains, while respecting Brazil’s compliance and operational realities.

Silicon Carbide Grade Deep-Dive for Local Specification Teams

Comparative Properties of R-SiC, SSiC, and RBSiC/SiSiC for Brazilian Engineers

| Parameter | SSiC | RBSiC / SiSiC | R-SiC |

|---|---|---|---|

| Open Porosity (%) | <0.5 | 10–16 | 10–20 |

| Elastic Modulus (GPa) | 390–420 | 320–350 | 240–280 |

| Coefficient of Thermal Expansion (10^-6/K) | 4.0–4.5 | 4.0–4.5 | 4.0–4.5 |

| Thermal Shock Resistance | High | Very high | High |

| Corrosion Resistance (chlorides/acids) | Excellent | Very good | Good |

| Achievable Surface Finish (Ra, µm) | ≤0.02 with lapping | 0.1–0.4 typical | 0.2–0.5 typical |

| Typical Brazilian Applications | Mechanical seal faces, bearings | Hydrocyclones, nozzles, liners | Kiln furniture, porous filters |

| Cost-to-Performance Fit | Premium for critical services | Balanced for high-wear | Efficient for thermal/structural |

Selecting the right grade is a matter of balancing porosity, finish capability, cost, and duty cycle. Sicarbtech’s application engineers help Brazilian teams codify these trade-offs into ABNT-aligned specifications.

Future Market Opportunities and 2025+ Trends: Why SiC Is Central

Three converging trends will define adoption curves in Brazil. First, energy intensity metrics are tightening across mining and process industries, often linked to ESG-linked financing. Materials that reduce hydraulic losses and sustain efficiency—like SiC—directly support these objectives. Second, local content and reindustrialization initiatives, coupled with currency risk, are pushing OEMs to develop domestic capability for critical components. Sicarbtech’s technology transfer and factory establishment services are purpose-built for this shift, reducing lead times and FX exposure while preserving high-performance standards. Third, the maturation of predictive maintenance and IIoT means dimensional stability and surface integrity have outsized value, as they produce cleaner signals and fewer false positives in monitoring systems.

Analysts project mid-single-digit CAGR for Brazil’s advanced technical ceramics market through 2027, with SiC outpacing averages due to continued pre-salt investments and mining expansions. Procurement teams will reward suppliers that bring not just parts, but application engineering, documentation, and training that shorten the road to qualification. In this environment, Sicarbtech’s full-stack capability—from powder to performance validation—positions it as a strategic partner rather than a transactional vendor.

Frequently Asked Questions

How does Sicarbtech align SiC components with ABNT, ANP, and IBAMA requirements?

We design components to API 610/682 and, where applicable, NACE MR0175/ISO 15156, format traceability and test records for ANP procurement, and align materials characterization to ABNT NBR references. Environmental and safety documentation supports IBAMA and NR norms to streamline licensing and installation.

Can Sicarbtech localize production in Brazil via technology transfer?

Yes. We deliver complete process know-how, equipment specifications, operator and QC training, SPC frameworks, and commissioning support for R-SiC, SSiC, RBSiC, and SiSiC. This enables rapid ramp-up and stable yields within Brazilian facilities.

Which SiC grade is recommended for pre-salt mechanical seal faces?

SSiC typically offers the best combination of near-zero porosity, chloride resistance, and ultra-flat lapping capability. Final selection depends on P–T profiles, counterface materials, and flatness stability under load.

What ROI timelines are typical for mining hydrocyclone upgrades?

Most sites see payback within 6–12 months due to extended wear life, fewer stoppages, and modest energy savings from smoother flow. Site-specific slurry composition and operating regime influence results.

Do SiC components help reduce environmental risk?

Yes. Improved sealing integrity and extended maintenance intervals reduce leakage risks and waste, supporting IBAMA-related licensing obligations and corporate ESG targets.

Can Sicarbtech supply drop-in replacements without equipment redesign?

Frequently. We engineer SiC inserts and liners that match existing envelopes and mounting features. Where beneficial, we propose subtle geometry optimizations that deliver performance gains without hardware changes.

How does Sicarbtech handle documentation for vendor qualification in Brazil?

We provide comprehensive data packs—chemical and physical properties, NDT, dimensional inspection, and process certifications—formatted for ABNT and ANP expectations to accelerate approvals.

What after-sales support is available locally?

Sicarbtech delivers remote engineering support, periodic site visits through Brazilian partners, and continuous improvement reviews. We co-develop stocking plans to mitigate logistics risk around shutdowns and harvest seasons.

Are there cost-effective SiC options for non-critical services?

Yes. RBSiC and R-SiC deliver strong value where ultimate corrosion resistance or ultra-flat finishes are not mandatory. We model lifecycle cost to recommend the optimal grade.

What information is needed to start a custom SiC component design?

Process media chemistry, particle size distribution, operating temperature and pressure ranges, existing failure modes, target service life, and assembly drawings. We work under NDA and follow a structured DfM and validation plan.

Making the Right Choice for Your Operations

Choosing advanced silicon carbide is more than a materials upgrade; it is a decision to stabilize process economics and compliance. With Sicarbtech, Brazilian manufacturers gain a partner that unites high-performance SiC grades, application engineering, and turnkey manufacturing capabilities. Whether your goal is to extend hydrocyclone life in Pará, secure seal reliability on pre-salt platforms, or tame corrosive abrasion in fertilizer lines, Sicarbtech aligns materials, design, and documentation to your operational and regulatory realities.

Get Expert Consultation and Custom Solutions

Engage Sicarbtech’s engineering team to translate your duty conditions into a robust SiC solution with a clear ROI case. We will align specifications with ABNT, ANP, and IBAMA requirements and support you from prototype to qualification and scale-up.

Sicarbtech – Silicon Carbide Solutions Expert

Email: [email protected]

Phone: +86 133 6536 0038

Article Metadata

Last updated: 2025-09-22

Next scheduled update: 2025-12-15

Content freshness indicators: 2025 Brazil outlook incorporated; ABNT/ANP/IBAMA alignment reviewed; three comparison tables validated; new Brazilian case studies added; technology transfer section expanded with ISO guidance.

About the Author: Sicarb Tech

We provide clear and reliable insights into silicon carbide materials, component manufacturing, application technologies, and global market trends. Our content reflects industry expertise, practical experience, and a commitment to helping readers understand the evolving SiC landscape.